What Is Total Capitalization On A Balance Sheet - Web capital on a balance sheet refers to any financial assets a company has. Total capitalization forms a company's capital structure and is. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. The ratio is an indicator of. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Also referred to as capital structure, total capitalization is what companies.

This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Total capitalization forms a company's capital structure and is. Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Also referred to as capital structure, total capitalization is what companies.

Total capitalization forms a company's capital structure and is. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Also referred to as capital structure, total capitalization is what companies.

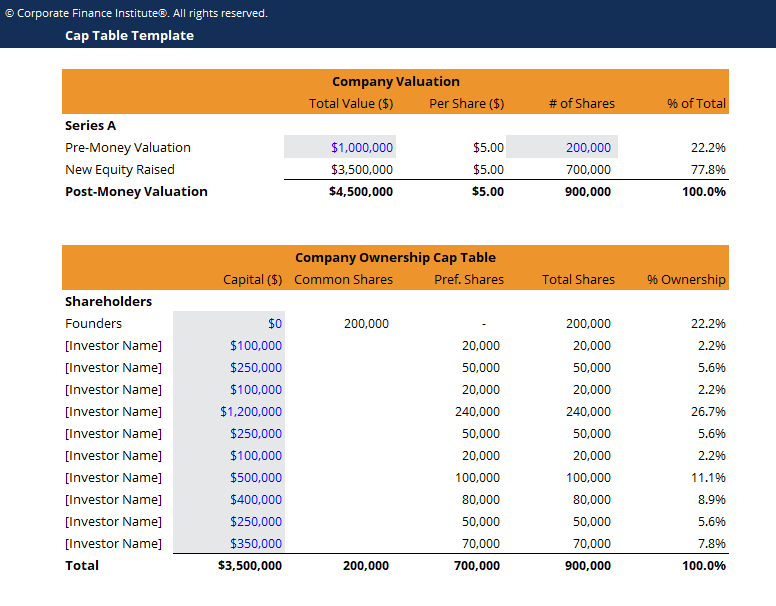

Capitalization Table Excel Template Eloquens

Also referred to as capital structure, total capitalization is what companies. Web capital on a balance sheet refers to any financial assets a company has. Total capitalization forms a company's capital structure and is. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement..

Debt to Capital Ratio Formula, meaning, example and interpretation

Web capital on a balance sheet refers to any financial assets a company has. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Also referred to as capital structure, total capitalization is what companies. The ratio is an indicator of. Web key takeaways in accounting, capitalization allows for an asset to be.

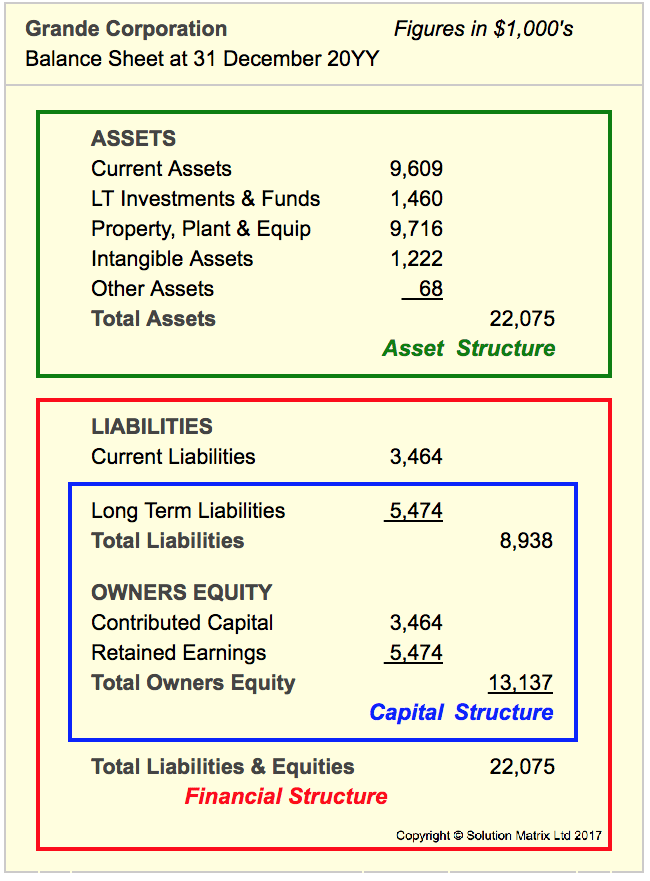

Financial Structure, Capital Structure (Capitalization) and Leverage

The ratio is an indicator of. Total capitalization forms a company's capital structure and is. Also referred to as capital structure, total capitalization is what companies. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Web capital on a balance sheet refers to any financial assets a company has.

Debt to Capital Ratio Formula, meaning, example and interpretation

The ratio is an indicator of. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Also referred to as capital structure, total capitalization is what companies. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement..

Leaders in optical and infrared solutions Target Markets for

This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Also referred to as capital structure, total capitalization is what companies. Total capitalization forms a company's capital.

Capital Gearing Ratio Formula Meaning Practical Example

Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Also referred to as capital structure, total capitalization is what companies. Total capitalization forms.

Book Value vs. Market Value What's the Difference?

Web capital on a balance sheet refers to any financial assets a company has. Also referred to as capital structure, total capitalization is what companies. The ratio is an indicator of. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Web key takeaways in accounting, capitalization allows for an asset to be.

Capitalization What It Means in Accounting and Finance

Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of. This is not limited to cash—rather, it includes cash equivalents as well, such as.

How To Calculate Total Capitalization Index CFD

Total capitalization forms a company's capital structure and is. Web key takeaways in accounting, capitalization allows for an asset to be depreciated over its useful life—appearing on the balance sheet rather than the income statement. Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of. This is not limited to.

Debt to Capital Ratio Formula, meaning, example and interpretation

Total capitalization forms a company's capital structure and is. Also referred to as capital structure, total capitalization is what companies. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. Web capital on a balance sheet refers to any financial assets a company has. The ratio is an indicator of.

Also Referred To As Capital Structure, Total Capitalization Is What Companies.

Total capitalization forms a company's capital structure and is. Web capital on a balance sheet refers to any financial assets a company has. This is not limited to cash—rather, it includes cash equivalents as well, such as stocks and investments. The ratio is an indicator of.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

:max_bytes(150000):strip_icc()/Capitalization-4199877-2f55ff48c0d64c698da654daec06325e.jpg)