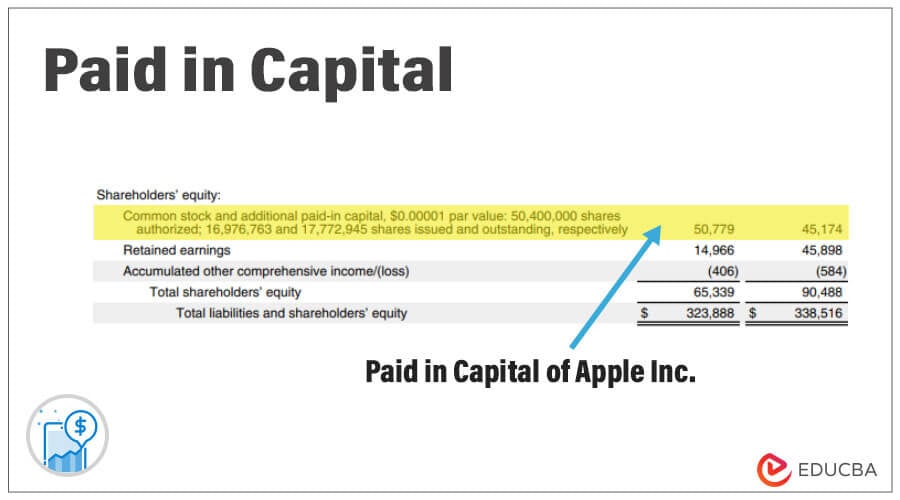

What Is Paid In Capital On The Balance Sheet - Paid in capital is the payments received from investors in exchange for an entity's stock. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. This is one of the key components of the total equity of a business. Web what is paid in capital?

Paid in capital is the payments received from investors in exchange for an entity's stock. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. This is one of the key components of the total equity of a business. Web what is paid in capital?

Web what is paid in capital? Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. Paid in capital is the payments received from investors in exchange for an entity's stock. This is one of the key components of the total equity of a business.

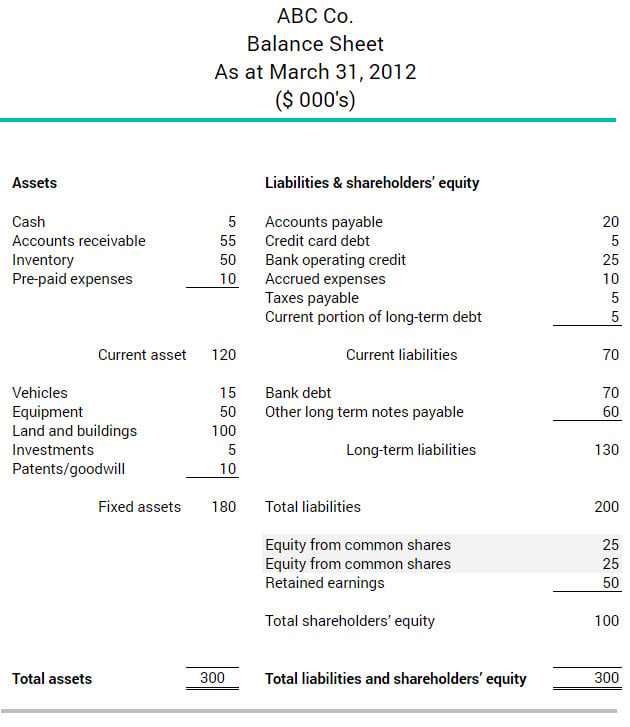

What is Share Capital? Types of Share Capital, Definition & Break Down

Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. This is one of the key components of the total equity of a business. Paid in capital is the payments.

29+ mortgage initial disclosures RaajEleonore

This is one of the key components of the total equity of a business. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. Web what is paid in capital?.

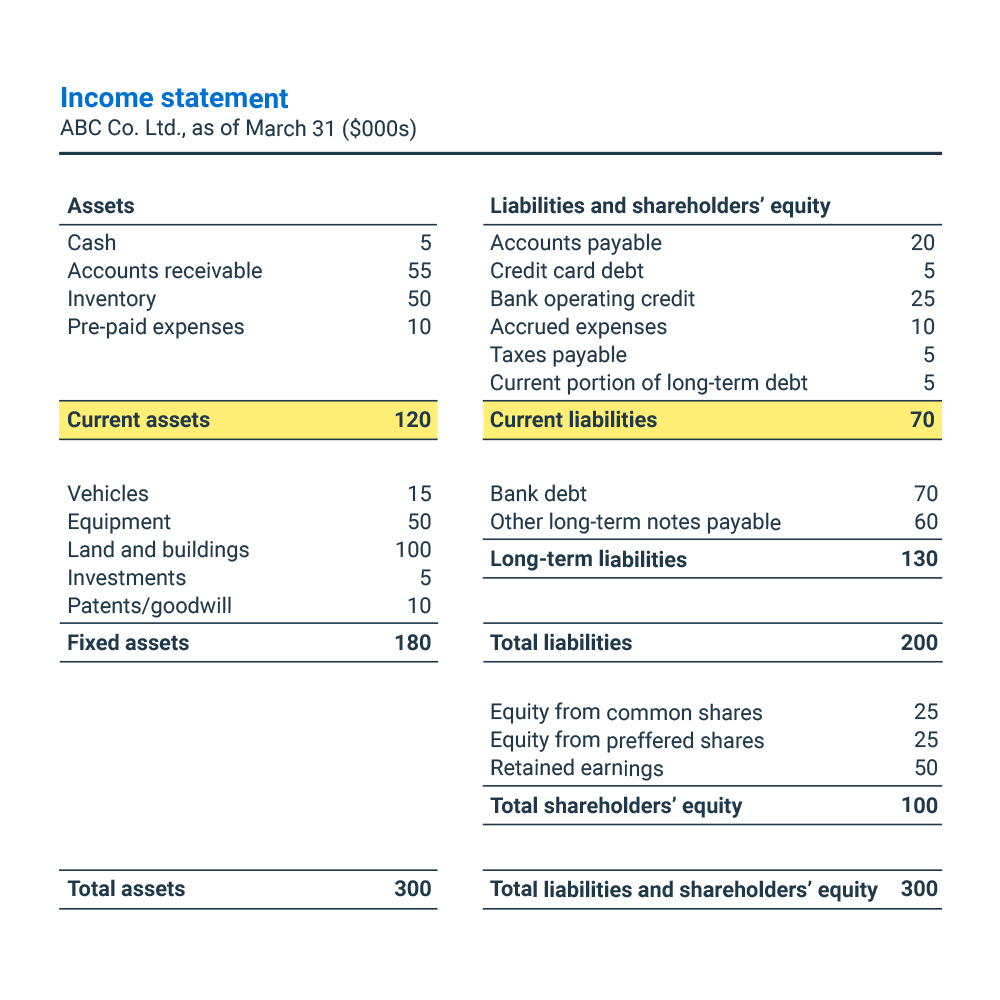

What is working capital? Formula, ratio and examples BDC.ca

Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. This is one of the key components of the total equity of a business. Paid in capital is the payments.

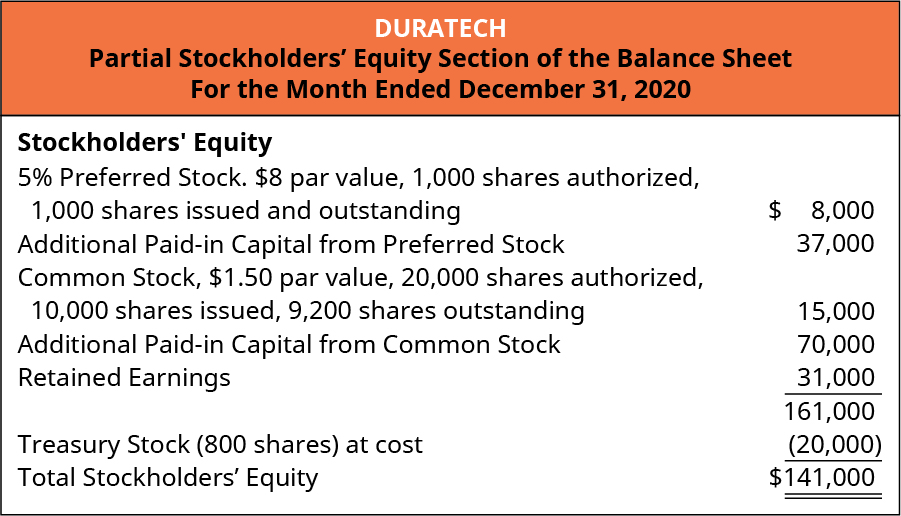

Does APIC have a debit or credit balance? Leia aqui Does APIC have a

Paid in capital is the payments received from investors in exchange for an entity's stock. This is one of the key components of the total equity of a business. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer,.

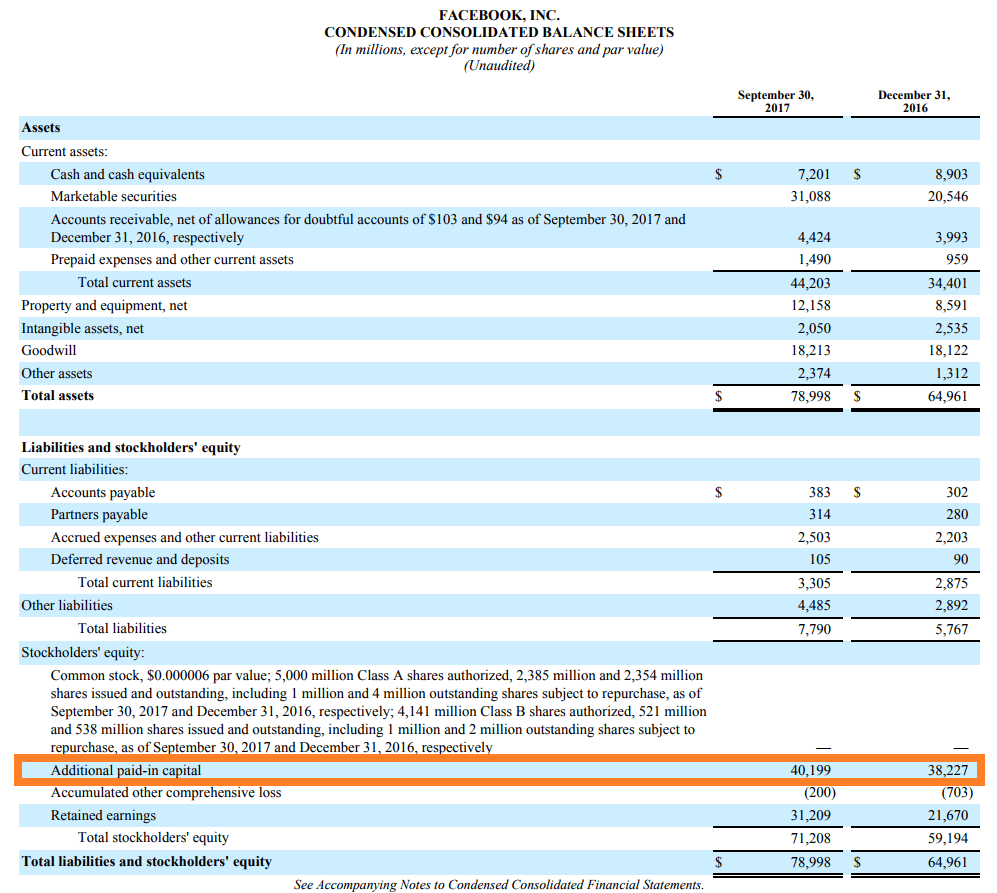

Paidin Capital and the Balance Sheet

Web what is paid in capital? This is one of the key components of the total equity of a business. Paid in capital is the payments received from investors in exchange for an entity's stock. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly.

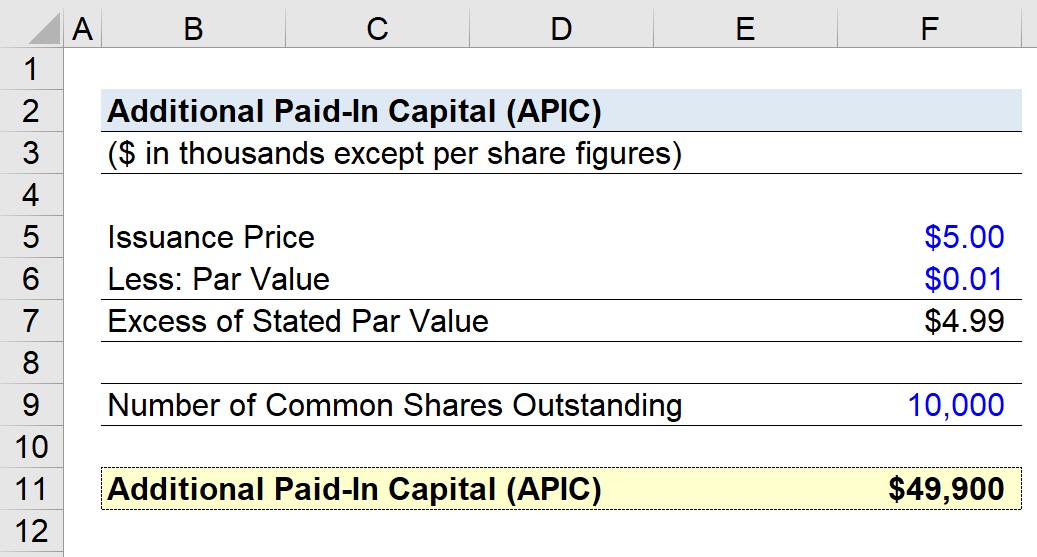

Additional PaidIn Capital (APIC) Formula + Calculation

Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. Web what is paid in capital? Paid in capital is the payments received from investors in exchange for an entity's.

What is share capital BDC.ca

Web what is paid in capital? Paid in capital is the payments received from investors in exchange for an entity's stock. This is one of the key components of the total equity of a business. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly.

Additional PaidUp Capital on Balance Sheet Importance and Example

Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. Paid in capital is the payments received from investors in exchange for an entity's stock. Web what is paid in.

Additional Paid In Capital Definition, Calculation & Examples

Paid in capital is the payments received from investors in exchange for an entity's stock. This is one of the key components of the total equity of a business. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer,.

Beautiful Capital Injection Balance Sheet Pepsico Financial Analysis

Paid in capital is the payments received from investors in exchange for an entity's stock. This is one of the key components of the total equity of a business. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer,.

Web What Is Paid In Capital?

Paid in capital is the payments received from investors in exchange for an entity's stock. Web paid in capital is the amount received by the company in exchange for the stock sold in the primary market, i.e., stock sold directly to the investors by the issuer, and not in the secondary market where investors sell. This is one of the key components of the total equity of a business.