Should Liabilities Be Negative On Balance Sheet - Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Some older accounting software used minus signs or parentheses to indicate. Web negative liability on balance sheet updated: Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. It calculates how much the company worth. Web why would a balance sheet list current liabilities as negative amounts? For example, if you were to accidentally pay a supplier's.

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web negative liability on balance sheet updated: Web why would a balance sheet list current liabilities as negative amounts? It calculates how much the company worth. Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. For example, if you were to accidentally pay a supplier's. Some older accounting software used minus signs or parentheses to indicate.

It calculates how much the company worth. Some older accounting software used minus signs or parentheses to indicate. Web negative liability on balance sheet updated: Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Web why would a balance sheet list current liabilities as negative amounts? Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. For example, if you were to accidentally pay a supplier's.

Ultimate Guide To Your Balance Sheet Profit And Loss Statement

Some older accounting software used minus signs or parentheses to indicate. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. It calculates how much the company worth. Web negative liability on balance sheet updated: Reasons for negative current liabilities on a balance sheet.

Understanding Negative Balances in Your Financial Statements Fortiviti

Web negative liability on balance sheet updated: Some older accounting software used minus signs or parentheses to indicate. It calculates how much the company worth. Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn.

Negative Working Capital Formula + Calculator

Reasons for negative current liabilities on a balance sheet. Web why would a balance sheet list current liabilities as negative amounts? Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. For example,.

Under Which method ledger accounts are totaled and their closing

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web why would a balance sheet list current liabilities as negative amounts? Web negative liability on balance sheet updated: Web when a negative cash balance is present, it is customary to avoid showing it on the balance.

Main Functions of Accounting

It calculates how much the company worth. Reasons for negative current liabilities on a balance sheet. For example, if you were to accidentally pay a supplier's. Web negative liability on balance sheet updated: Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date.

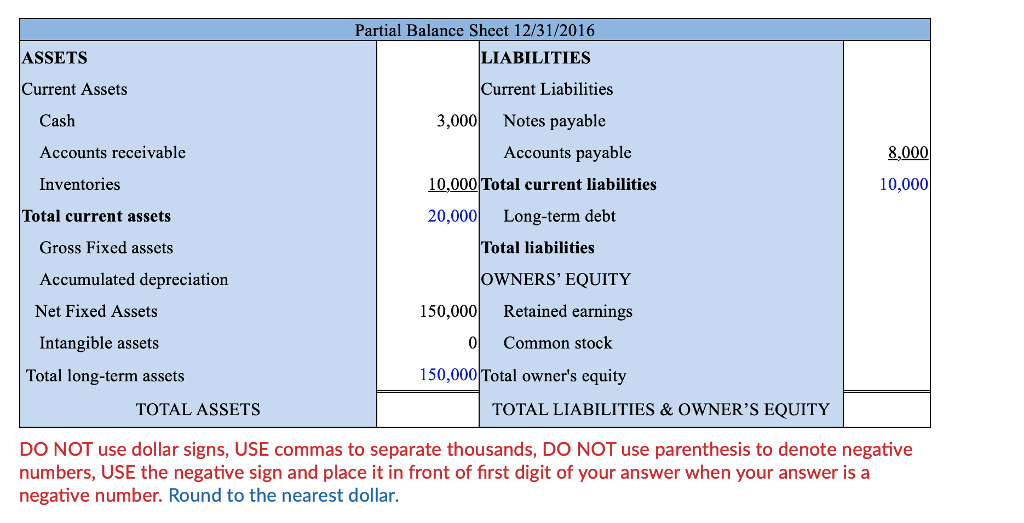

Solved Balance sheet. Use the data from the financial

Reasons for negative current liabilities on a balance sheet. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. It calculates how much the company worth. Jun 20, 2023 a balance sheet gives.

Negative Shareholders Equity Examples Buyback Losses

For example, if you were to accidentally pay a supplier's. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Reasons for negative current liabilities on a balance sheet. Web a negative liability.

A Beginner's Guide to the Types of Liabilities on a Balance Sheet

Web negative liability on balance sheet updated: Some older accounting software used minus signs or parentheses to indicate. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Reasons for negative current liabilities.

Liabilities How to classify, Track and calculate liabilities?

Web why would a balance sheet list current liabilities as negative amounts? Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Some older accounting software used minus signs or parentheses to indicate. For example, if you were to accidentally pay a supplier's. Web when a negative cash balance is present,.

Stockholders' Equity What It Is, How To Calculate It, Examples

Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date. Web why would a balance sheet list current liabilities as negative amounts? Web negative liability on balance sheet updated: Some older accounting software used minus signs or parentheses to indicate. Web a negative liability typically appears on the balance sheet when.

For Example, If You Were To Accidentally Pay A Supplier's.

It calculates how much the company worth. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web when a negative cash balance is present, it is customary to avoid showing it on the balance sheet by moving the amount of the overdrawn checks into a liability account and setting up the entry to. Web why would a balance sheet list current liabilities as negative amounts?

Web Negative Liability On Balance Sheet Updated:

Reasons for negative current liabilities on a balance sheet. Some older accounting software used minus signs or parentheses to indicate. Jun 20, 2023 a balance sheet gives you a financial snapshot of the company as of the specific date.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)