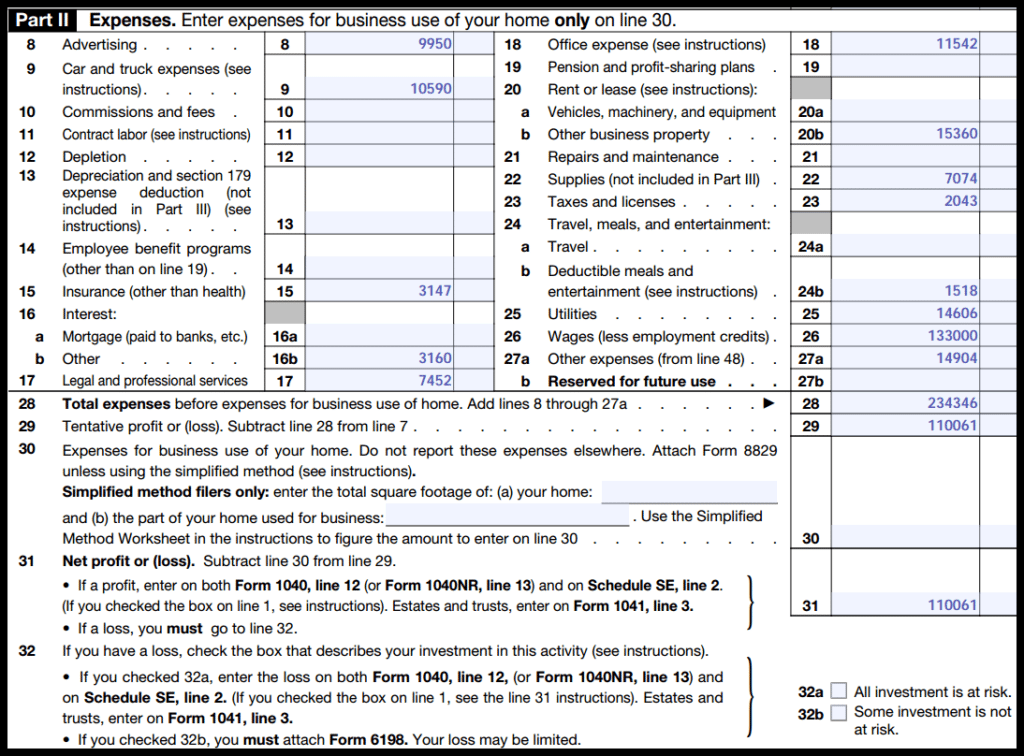

Schedule C Worksheet Amount Misc Exp Other Must Be Entered - You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review.

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review.

Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review.

Schedule C Expenses Worksheet 2022

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a.

What Is A Schedule C Worksheet

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

Schedule C Worksheet Misc Exp Other

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other”.

What Is A Schedule C Worksheet

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

Printable Schedule C Worksheet

Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

20++ Schedule C Worksheet Worksheets Decoomo

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other”.

What Is A Schedule C Worksheet

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

Schedule C Worksheet Amount Misc Exp Other

Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

Schedule C Worksheet Amount Misc Exp Other

Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a.

Schedule C Worksheet Amount Misc Exp Other

Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

You Have A Other Miscellaneous Expense Description Entered In Your Business Section Of Turbotax Without A Corresponding.

Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)