Salaries And Wages Expense On Balance Sheet - Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Discover best practices to manage and record your payroll! Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. These amounts affect the bottom line of your income statement, which affects the. However, labor expenses appear on the balance sheet as well, and in three. Selling, general administration, etc.) are part of the expenses reported on. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Web your balance sheet shows salaries, wages and expenses indirectly.

Web your balance sheet shows salaries, wages and expenses indirectly. However, labor expenses appear on the balance sheet as well, and in three. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. These amounts affect the bottom line of your income statement, which affects the. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Discover best practices to manage and record your payroll! Selling, general administration, etc.) are part of the expenses reported on. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses.

Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Selling, general administration, etc.) are part of the expenses reported on. Discover best practices to manage and record your payroll! Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web your balance sheet shows salaries, wages and expenses indirectly. However, labor expenses appear on the balance sheet as well, and in three. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. These amounts affect the bottom line of your income statement, which affects the.

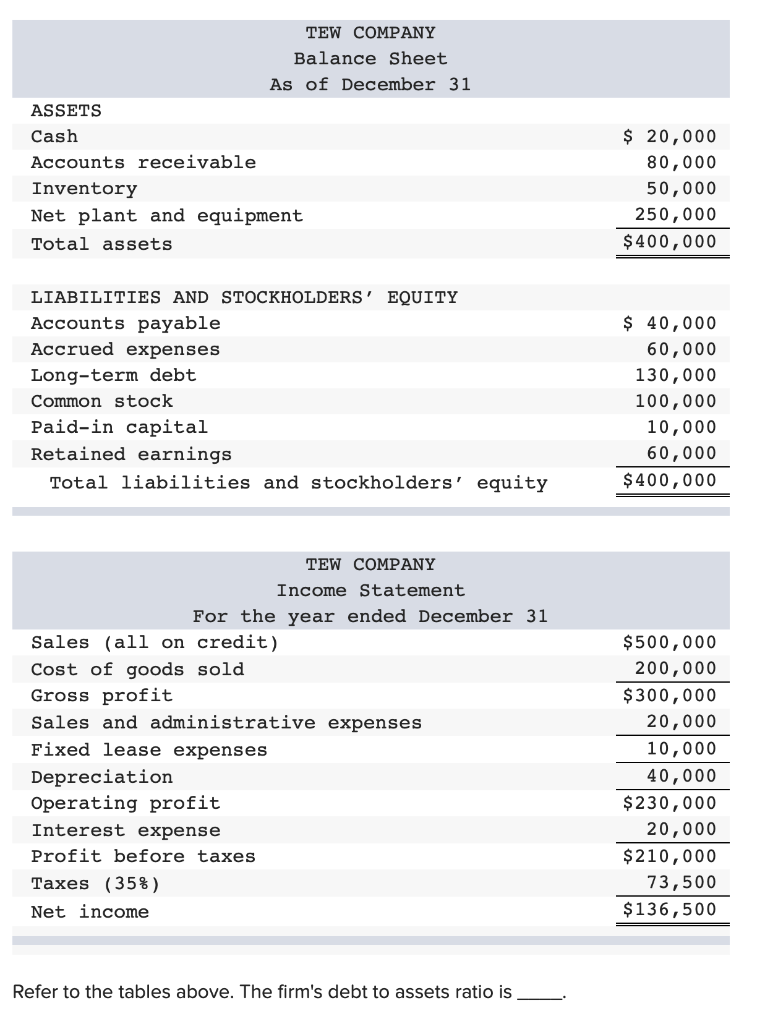

Solved TEW COMPANY Balance Sheet As of December 31 ASSETS

Discover best practices to manage and record your payroll! Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Selling, general administration, etc.) are part of the expenses reported.

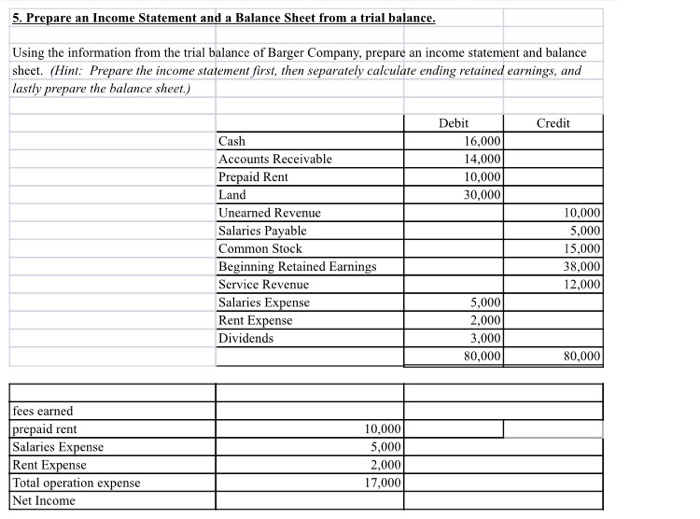

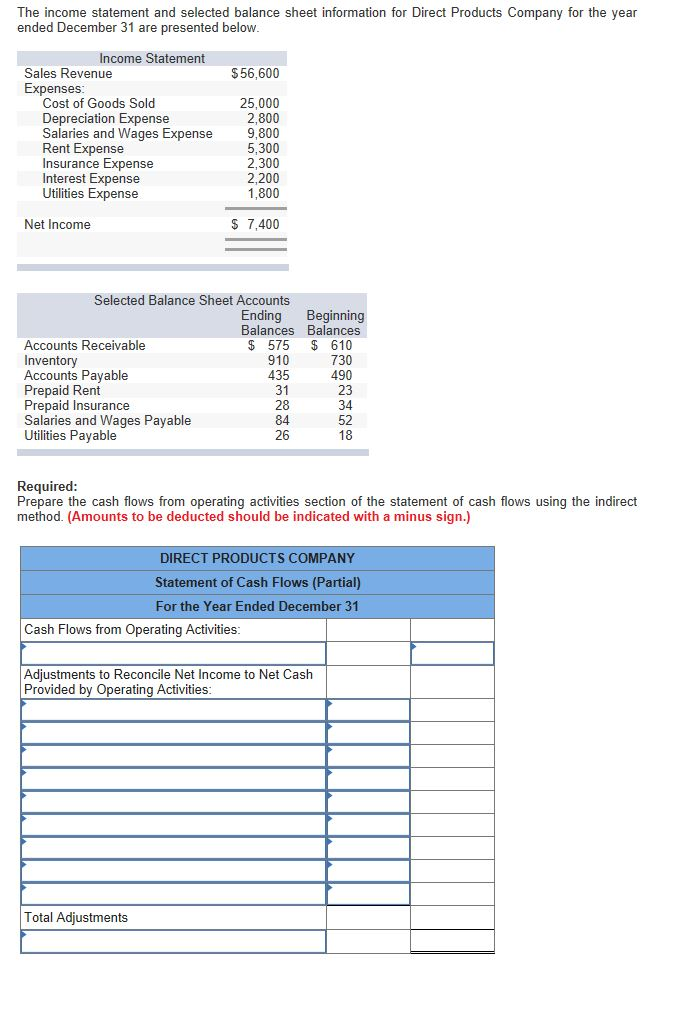

[Solved] statement and balance sheet excerp SolutionInn

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the..

Wages Payable Current Liability Accounting

Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Discover best practices to manage and record your payroll! Web your balance sheet shows salaries, wages and expenses indirectly. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the..

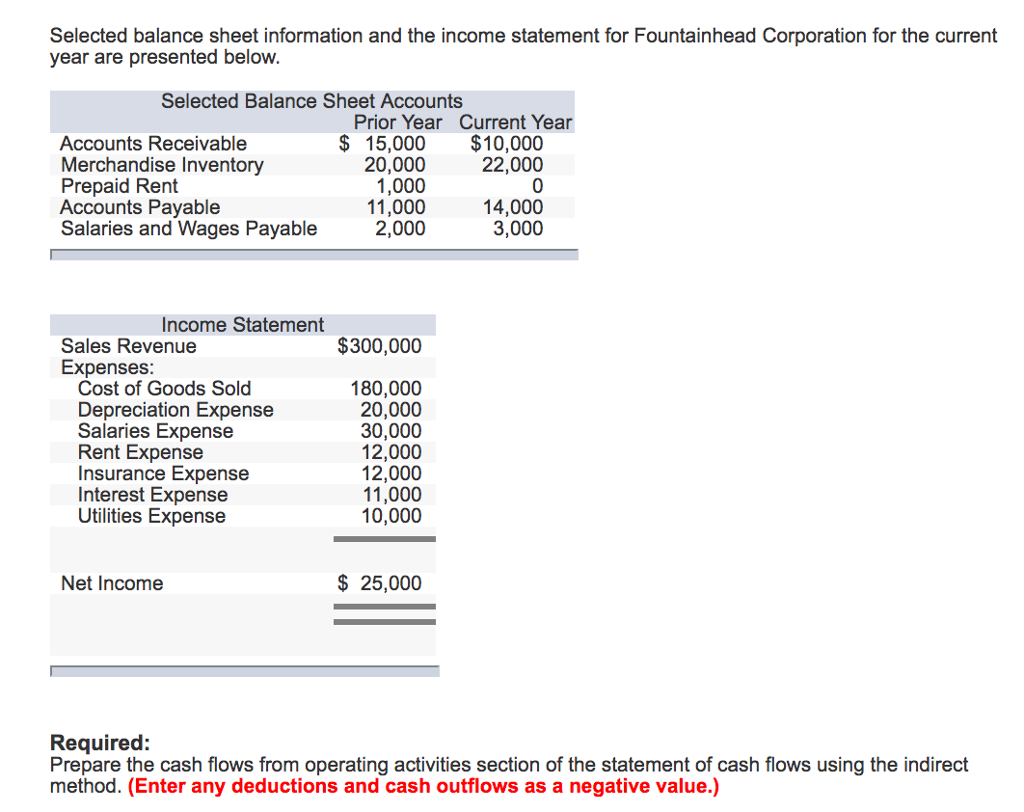

Solved Selected balance sheet information and the

Discover best practices to manage and record your payroll! However, labor expenses appear on the balance sheet as well, and in three. Selling, general administration, etc.) are part of the expenses reported on. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during.

The Differences in Wages Payable & Wages Expense Business Accounting

Discover best practices to manage and record your payroll! Selling, general administration, etc.) are part of the expenses reported on. These amounts affect the bottom line of your income statement, which affects the. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web salaries and wages of a company's employees.

Salaries And Wages Expense Balance Sheet Financial Statement

Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Discover best practices to manage and record your payroll! Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used.

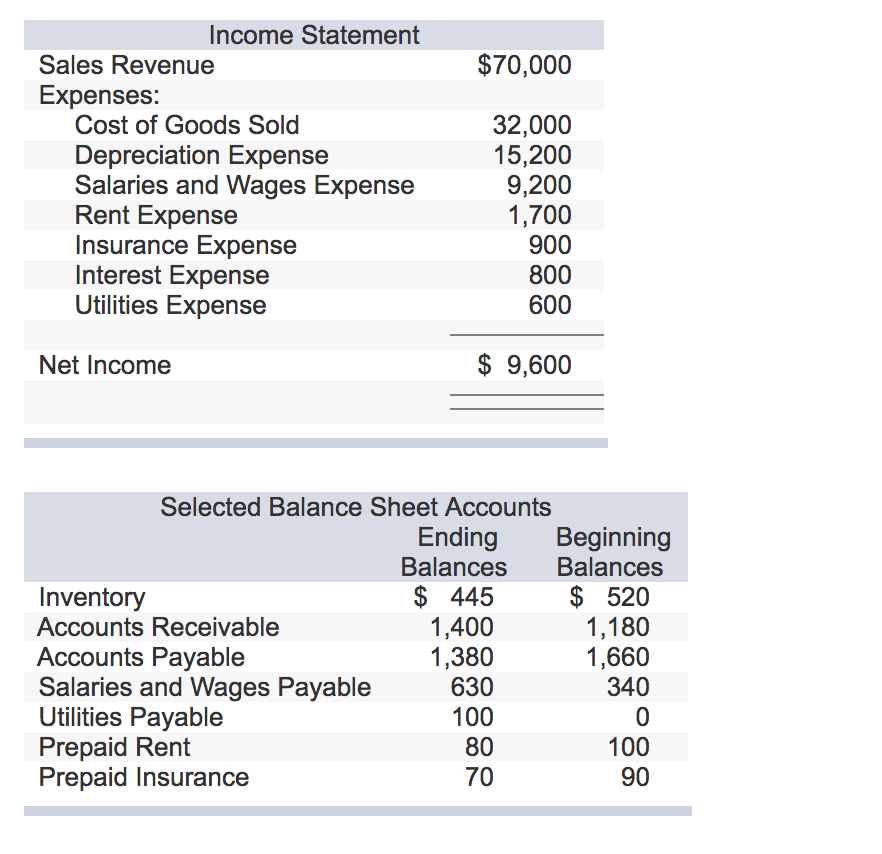

Solved The statement and selected balance sheet

Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web your balance sheet shows salaries, wages and expenses indirectly. Discover best practices to manage and record your payroll! Web most students learn that labor and wages are a cost item on.

Accrued Salaries In Balance Sheet Schedule 6 Format Pdf Financial

Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web your balance sheet shows salaries, wages and expenses indirectly. Web salaries and.

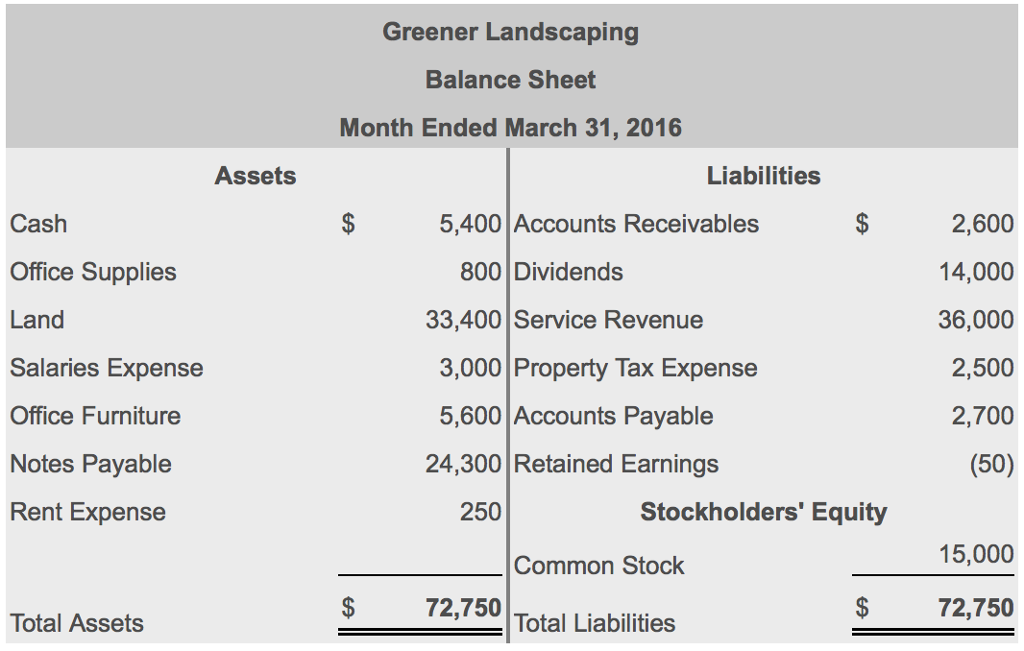

Solved Assets Cash Office Supplies and Salaries Expense

Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Discover best practices to manage and record your payroll! However, labor expenses appear on the balance sheet as well, and in three. Web your balance sheet shows salaries, wages and expenses indirectly. Web the account wages and salaries expense (or separate accounts such as.

Solved The statement and selected balance sheet

Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the. Discover best practices to manage and record your payroll! Web your balance sheet shows salaries, wages and expenses indirectly. Web a payroll journal entry is an accounting method to control gross wages.

However, Labor Expenses Appear On The Balance Sheet As Well, And In Three.

Web salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Selling, general administration, etc.) are part of the expenses reported on. Web the account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the.

These Amounts Affect The Bottom Line Of Your Income Statement, Which Affects The.

Web your balance sheet shows salaries, wages and expenses indirectly. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Discover best practices to manage and record your payroll!

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)