Negative Cash Balance On Balance Sheet - Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web there are two options for which liability account to use to store the overdrawn amount, which are: The more theoretically correct approach is to segregate the overdrawn. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Or you can also include the amount in accounts payable. Web how do you fix a negative cash balance? In both cases, the negative cash balance should be presented in the liabilities section of. If you want to solve a problem, you must first identify the source of the problem. Web cash overdraft in balance sheet.

Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web cash overdraft in balance sheet. The more theoretically correct approach is to segregate the overdrawn. In both cases, the negative cash balance should be presented in the liabilities section of. If you want to solve a problem, you must first identify the source of the problem. The credit or negative balance in the checking account is usually caused by a company writing checks for. Or you can also include the amount in accounts payable. Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web there are two options for which liability account to use to store the overdrawn amount, which are:

Web cash overdraft in balance sheet. In both cases, the negative cash balance should be presented in the liabilities section of. The credit or negative balance in the checking account is usually caused by a company writing checks for. The more theoretically correct approach is to segregate the overdrawn. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Or you can also include the amount in accounts payable. Web how do you fix a negative cash balance? Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. If you want to solve a problem, you must first identify the source of the problem. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities.

Cash App Showing Negative Balance [Fix] Techfixhub

Web cash overdraft in balance sheet. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web how do you fix a negative cash balance? The more theoretically correct approach is to segregate the overdrawn.

How to find Negative Cash Balance in Tally YouTube

Web cash overdraft in balance sheet. Or you can also include the amount in accounts payable. The more theoretically correct approach is to segregate the overdrawn. In both cases, the negative cash balance should be presented in the liabilities section of. Web there are two options for which liability account to use to store the overdrawn amount, which are:

Negative Cash Balance r/Webull

Or you can also include the amount in accounts payable. Web how do you fix a negative cash balance? The credit or negative balance in the checking account is usually caused by a company writing checks for. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Web a negative.

Etrade Negative Cash Balance 4 Reasons & Solution

Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. In both cases, the negative cash balance should be presented in the liabilities section of. The more theoretically correct approach is to segregate the overdrawn. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities..

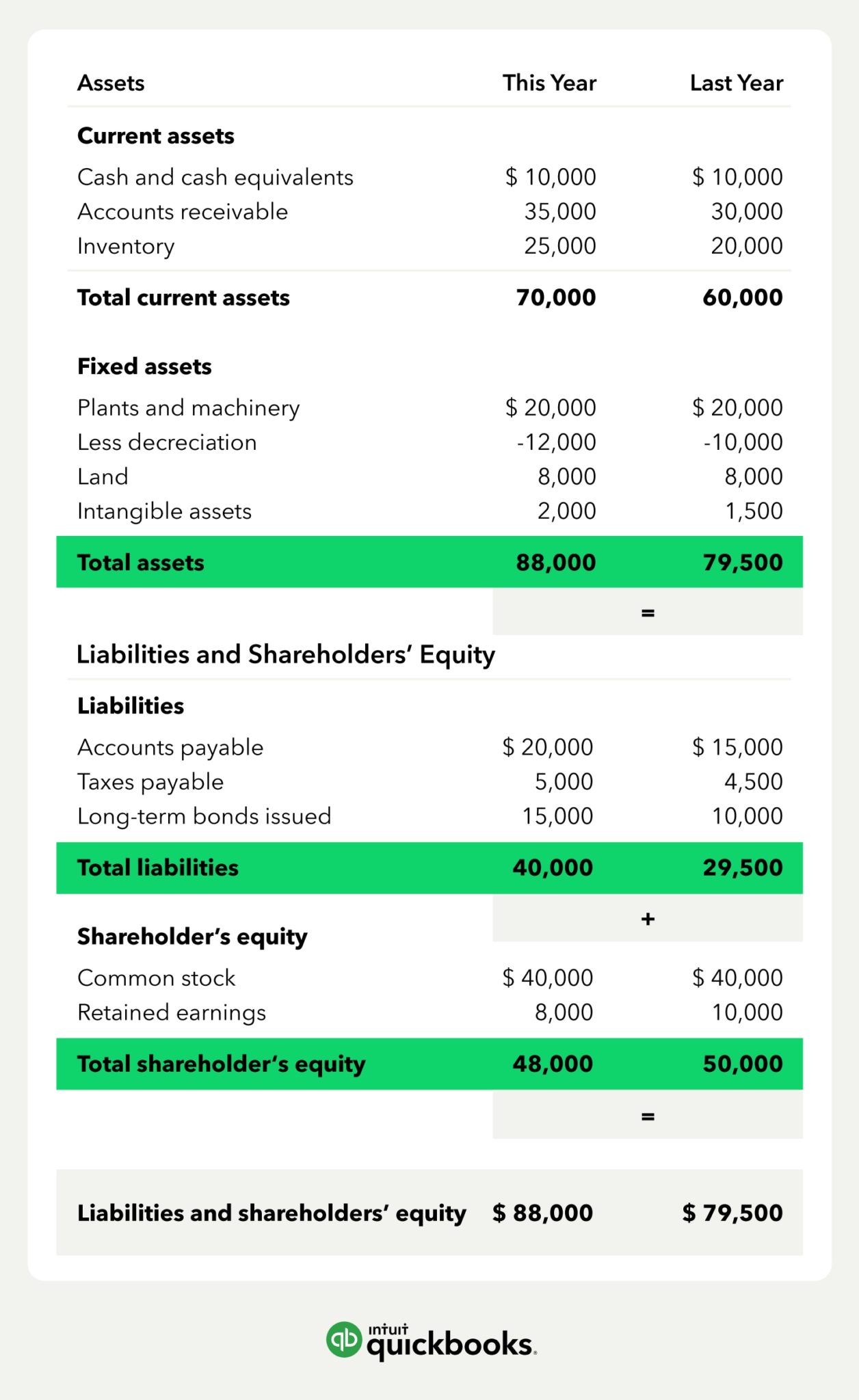

What Is a Financial Statement? Detailed Overview of Main Statements

Web there are two options for which liability account to use to store the overdrawn amount, which are: Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In both cases,.

Understanding Negative Balances in Your Financial Statements Fortiviti

If you want to solve a problem, you must first identify the source of the problem. Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web cash overdraft in balance sheet. In both cases, the negative cash balance should be presented in the liabilities section of. In the balance sheet,.

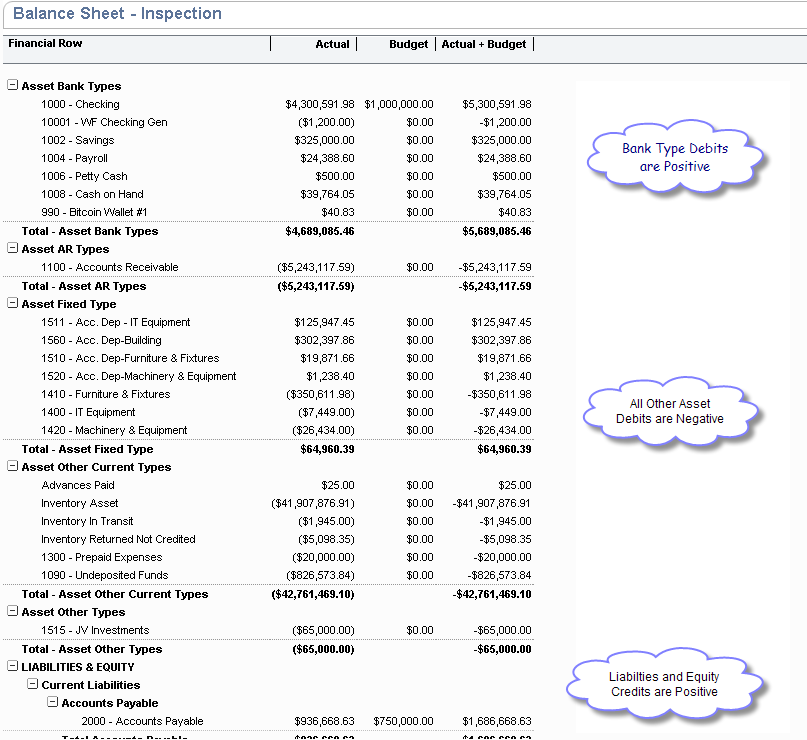

Marty Zigman on "The Pluses and Minuses of NetSuite Financial Statement

Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. The more theoretically correct approach is to segregate the overdrawn. Web how do you fix a negative cash balance? Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In both.

Negative Cash Flow (Meaning, Examples) How to Interpret?

Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web there are two options for which liability account to use to store the overdrawn amount, which are: Web a negative cash balance results.

Negative Cash Flow Investments in Companies

Web how do you fix a negative cash balance? If you want to solve a problem, you must first identify the source of the problem. In both cases, the negative cash balance should be presented in the liabilities section of. Or you can also include the amount in accounts payable. The more theoretically correct approach is to segregate the overdrawn.

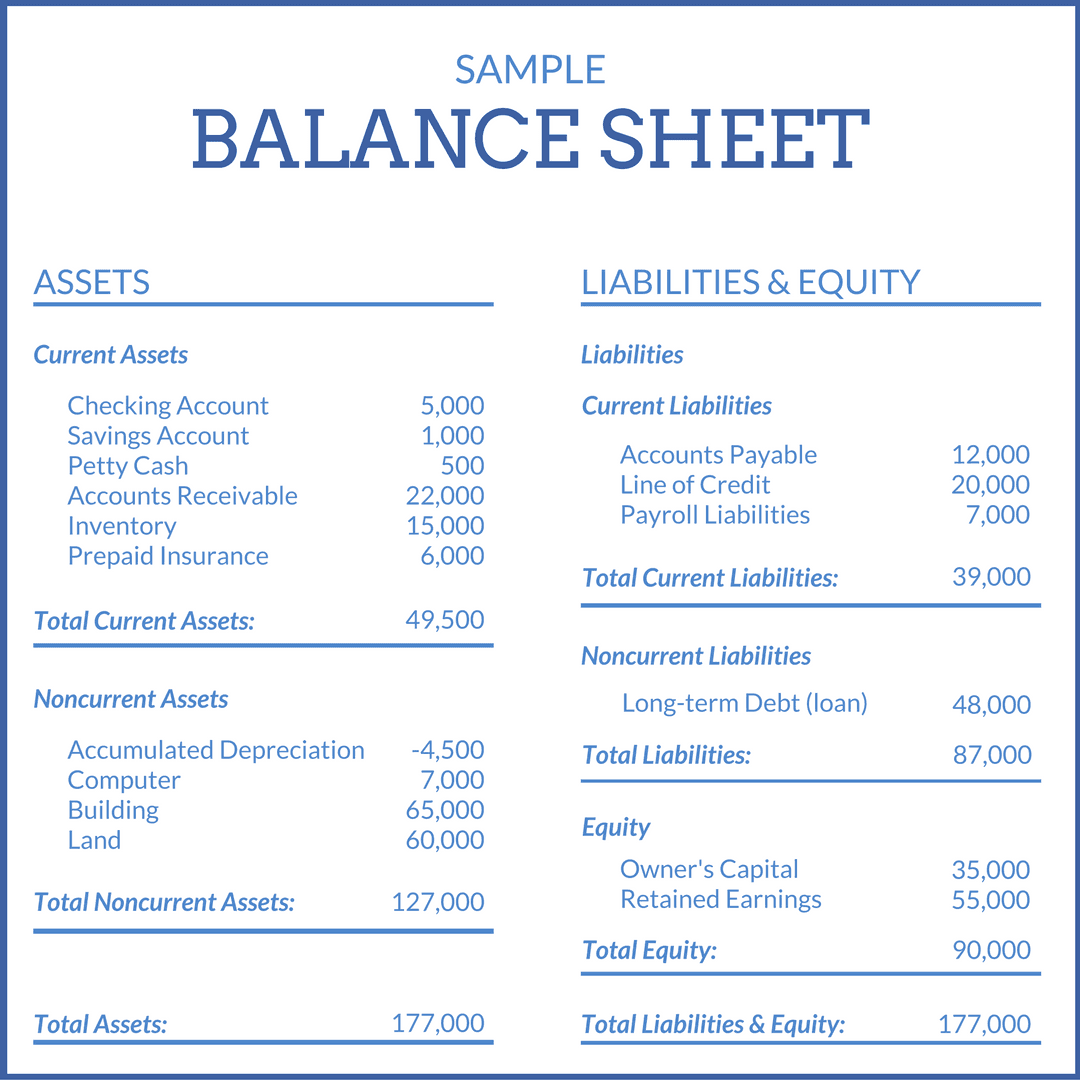

Balance Sheet — Financial Expertise You Can Take to the Bank

Web how do you fix a negative cash balance? If you want to solve a problem, you must first identify the source of the problem. Or you can also include the amount in accounts payable. Web there are two options for which liability account to use to store the overdrawn amount, which are: In the balance sheet, show the negative.

Web A Negative Cash Balance Results When The Cash Account In A Company's General Ledger Has A Credit Balance.

Web cash overdraft in balance sheet. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. The credit or negative balance in the checking account is usually caused by a company writing checks for. The more theoretically correct approach is to segregate the overdrawn.

In Both Cases, The Negative Cash Balance Should Be Presented In The Liabilities Section Of.

In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Or you can also include the amount in accounts payable. Web there are two options for which liability account to use to store the overdrawn amount, which are: If you want to solve a problem, you must first identify the source of the problem.

![Cash App Showing Negative Balance [Fix] Techfixhub](https://techfixhub.com/wp-content/uploads/2022/09/9vc6cwlha8c61-1.jpeg)