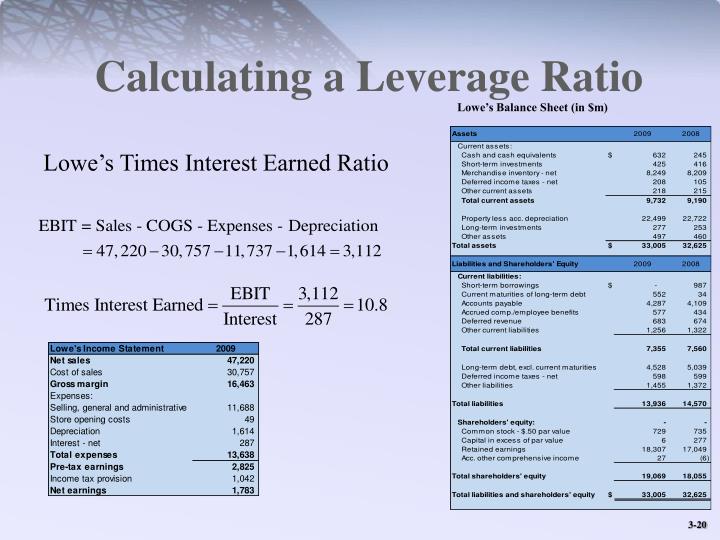

Leveraged Balance Sheet - Web below are 5 of the most commonly used leverage ratios: The financial leverage of a company is the proportion of debt in the. A leverage ratio may also be used to measure a company's. A company can analyze its leverage by seeing what percent of its assets have been. When a company uses debt financing, its financial leverage increases. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. More capital is available to. The financial leverage ratio is an indicator of how much.

The financial leverage of a company is the proportion of debt in the. When a company uses debt financing, its financial leverage increases. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. A company can analyze its leverage by seeing what percent of its assets have been. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A leverage ratio may also be used to measure a company's. More capital is available to. The financial leverage ratio is an indicator of how much. Web below are 5 of the most commonly used leverage ratios:

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. The financial leverage of a company is the proportion of debt in the. More capital is available to. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. When a company uses debt financing, its financial leverage increases. The financial leverage ratio is an indicator of how much. A company can analyze its leverage by seeing what percent of its assets have been. Web below are 5 of the most commonly used leverage ratios: A leverage ratio may also be used to measure a company's.

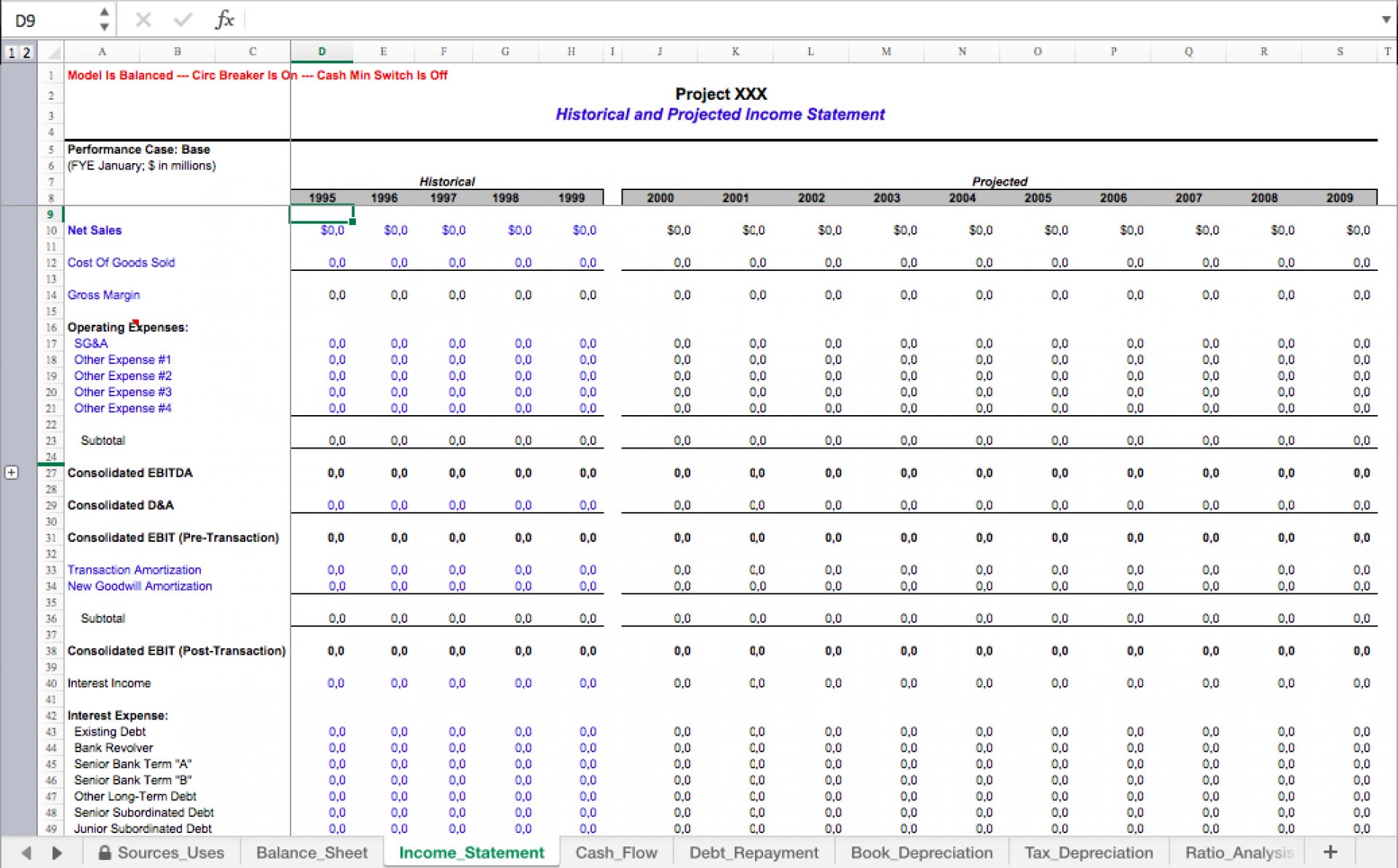

Lbo Model Template

More capital is available to. The financial leverage ratio is an indicator of how much. The financial leverage of a company is the proportion of debt in the. When a company uses debt financing, its financial leverage increases. A leverage ratio may also be used to measure a company's.

TriloBoat Talk Mechanical Advantage It's a Matter of Leverage

The financial leverage ratio is an indicator of how much. When a company uses debt financing, its financial leverage increases. A leverage ratio may also be used to measure a company's. More capital is available to. Web below are 5 of the most commonly used leverage ratios:

leveragea05.jpg

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. Web below are 5 of the most commonly used leverage ratios: A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage of a company is the proportion of.

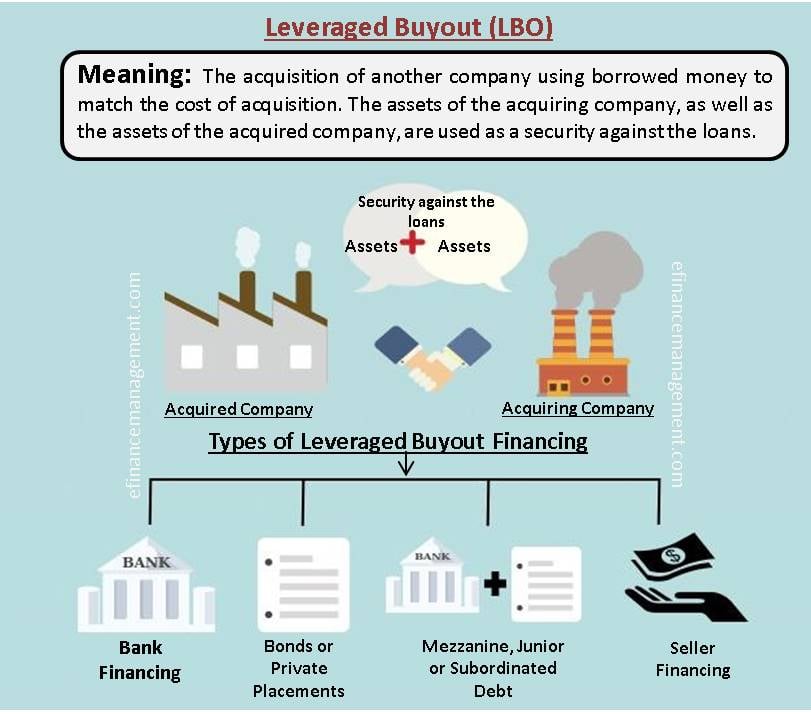

Financial Leverage Meaning, Measuring Ratios, Degree, Illustration eFM

The financial leverage ratio is an indicator of how much. When a company uses debt financing, its financial leverage increases. The financial leverage of a company is the proportion of debt in the. More capital is available to. A company can analyze its leverage by seeing what percent of its assets have been.

PPT Corporate Performance PowerPoint Presentation ID5436719

When a company uses debt financing, its financial leverage increases. Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. More capital is.

Balance Sheet Leverage Edu

The financial leverage of a company is the proportion of debt in the. When a company uses debt financing, its financial leverage increases. A company can analyze its leverage by seeing what percent of its assets have been. More capital is available to. Web a leverage ratio is any one of several financial measurements that assesses the ability of a.

Financial Training Modelling for a merger or LBO (leveraged buyout)

More capital is available to. The financial leverage of a company is the proportion of debt in the. A company can analyze its leverage by seeing what percent of its assets have been. Web below are 5 of the most commonly used leverage ratios: Web on the balance sheet, leverage ratios are used to measure the amount of reliance a.

Simple LBO Template Excel Model (Leveraged Buyout) Alexander Jarvis

A leverage ratio may also be used to measure a company's. The financial leverage of a company is the proportion of debt in the. The financial leverage ratio is an indicator of how much. Web below are 5 of the most commonly used leverage ratios: A company can analyze its leverage by seeing what percent of its assets have been.

Leveraged The New Economics of Debt and Financial Fragility, Schularick

More capital is available to. A company can analyze its leverage by seeing what percent of its assets have been. The financial leverage of a company is the proportion of debt in the. Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. When a company.

Leveraged Buyout, Balance Sheet Example YouTube

A leverage ratio may also be used to measure a company's. Web below are 5 of the most commonly used leverage ratios: Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A company can analyze its leverage by seeing what percent of its assets have been..

The Financial Leverage Of A Company Is The Proportion Of Debt In The.

Web on the balance sheet, leverage ratios are used to measure the amount of reliance a company has on creditors to fund its operation. More capital is available to. When a company uses debt financing, its financial leverage increases. A company can analyze its leverage by seeing what percent of its assets have been.

Web Below Are 5 Of The Most Commonly Used Leverage Ratios:

Web a leverage ratio is any one of several financial measurements that assesses the ability of a company to meet its financial obligations. A leverage ratio may also be used to measure a company's. The financial leverage ratio is an indicator of how much.