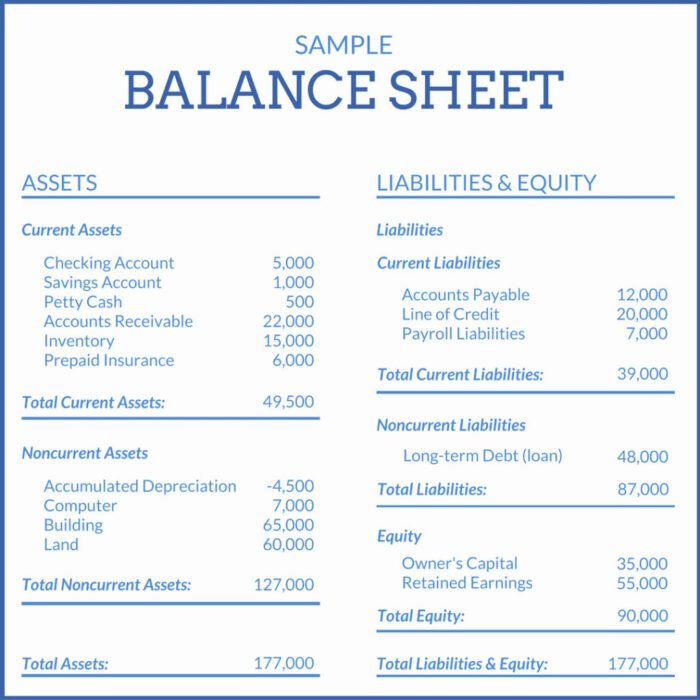

Is Service Revenue On A Balance Sheet - Accounts receivable and cash are reported. Web accountants list service revenue at the top of the income statement. Web is service revenue on a balance sheet? Service revenue always goes on the. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Web accounting for service revenue summary. A balance sheet describes a company's assets, liabilities, and stockholders' or. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web service revenue is the income a company generates from providing a service.

Web accountants list service revenue at the top of the income statement. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web accounting for service revenue summary. Service revenue always goes on the. Web service revenue is the income a company generates from providing a service. A balance sheet describes a company's assets, liabilities, and stockholders' or. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. It goes on a separate line item that is specific to revenue, below the sales revenue line. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a.

Web accountants list service revenue at the top of the income statement. Service revenue always goes on the. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web service revenue is the income a company generates from providing a service. Web is service revenue on a balance sheet? Accounts receivable and cash are reported. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web accounting for service revenue summary.

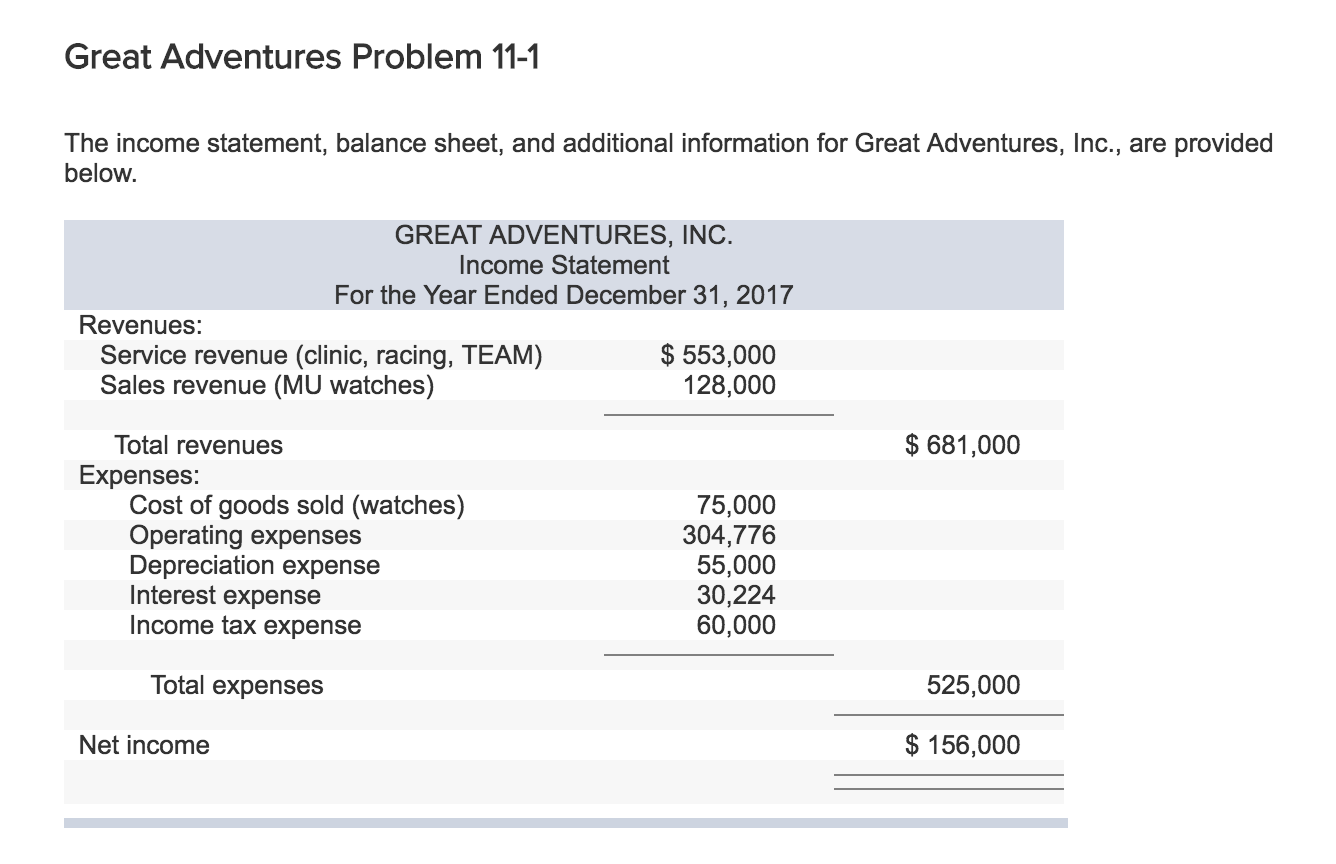

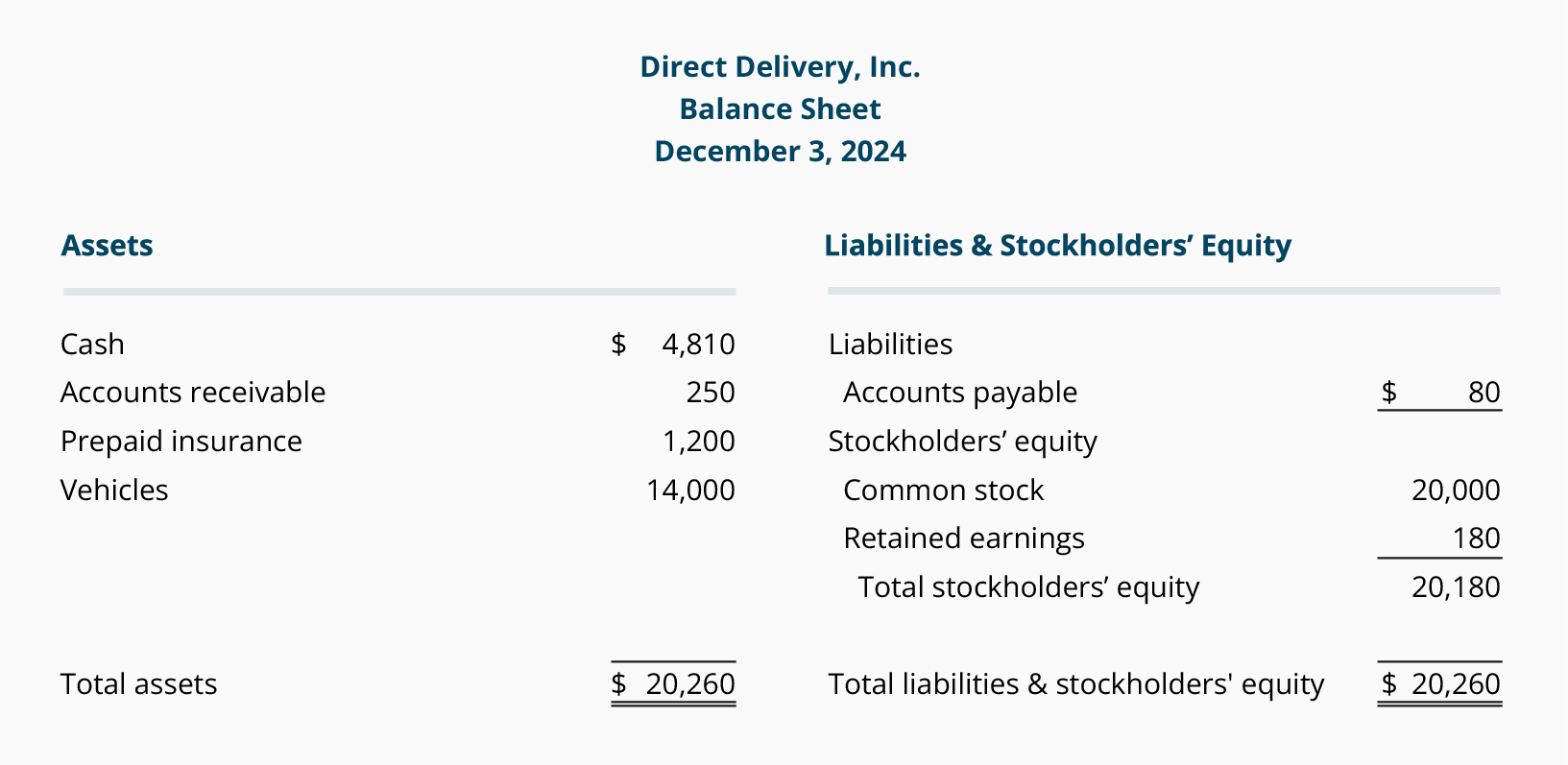

Solved statement and balance sheet data for Great

Accounts receivable and cash are reported. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web accounting for service revenue summary. It goes on a separate line item that is specific to revenue, below the sales revenue line. Service revenue appears on a balance sheet as an accounts receivable for.

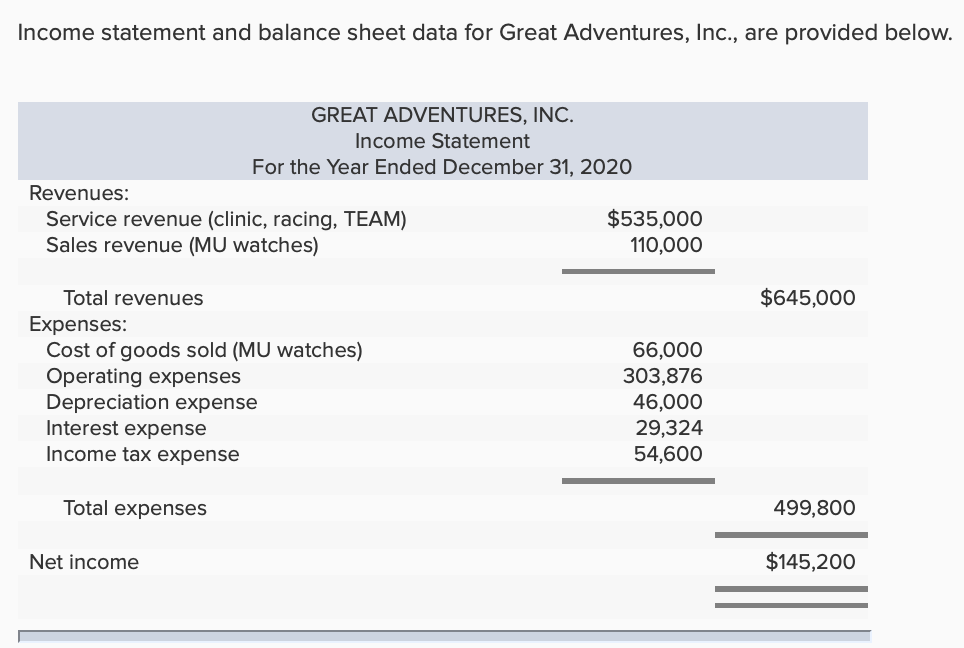

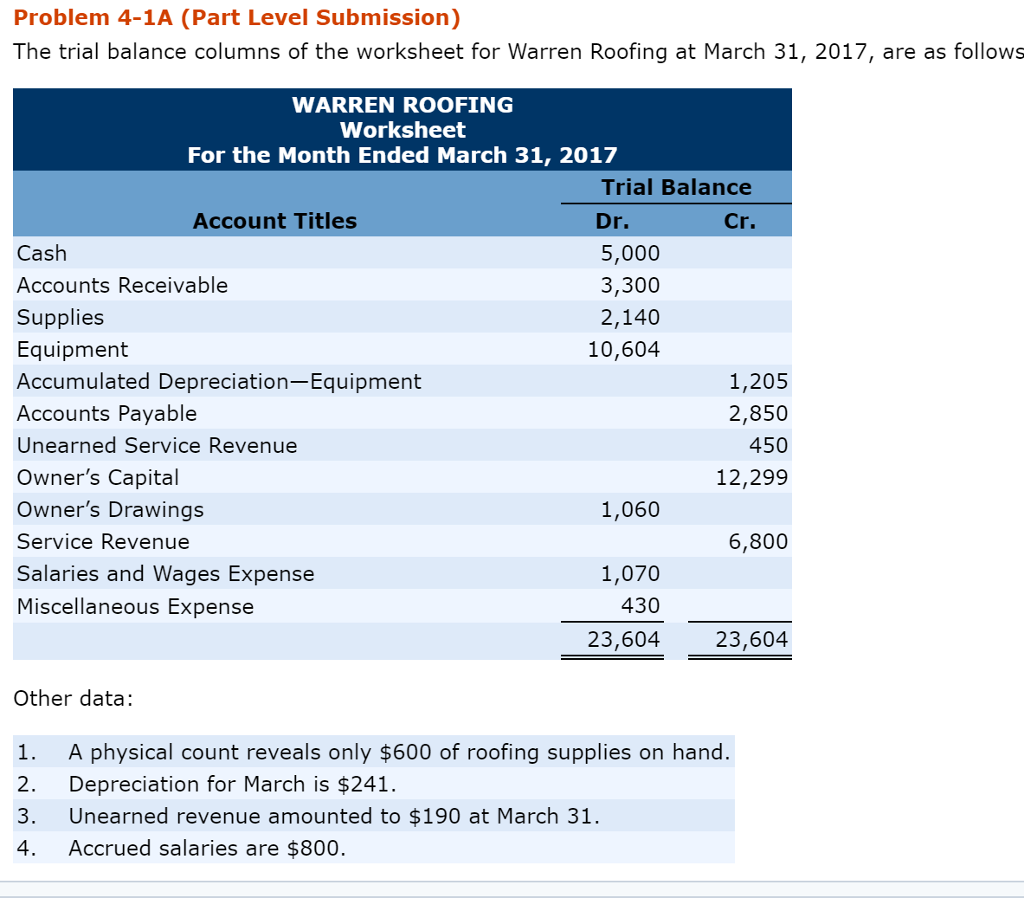

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

It goes on a separate line item that is specific to revenue, below the sales revenue line. Service revenue always goes on the. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web is service revenue on a balance sheet? Web service revenue is the.

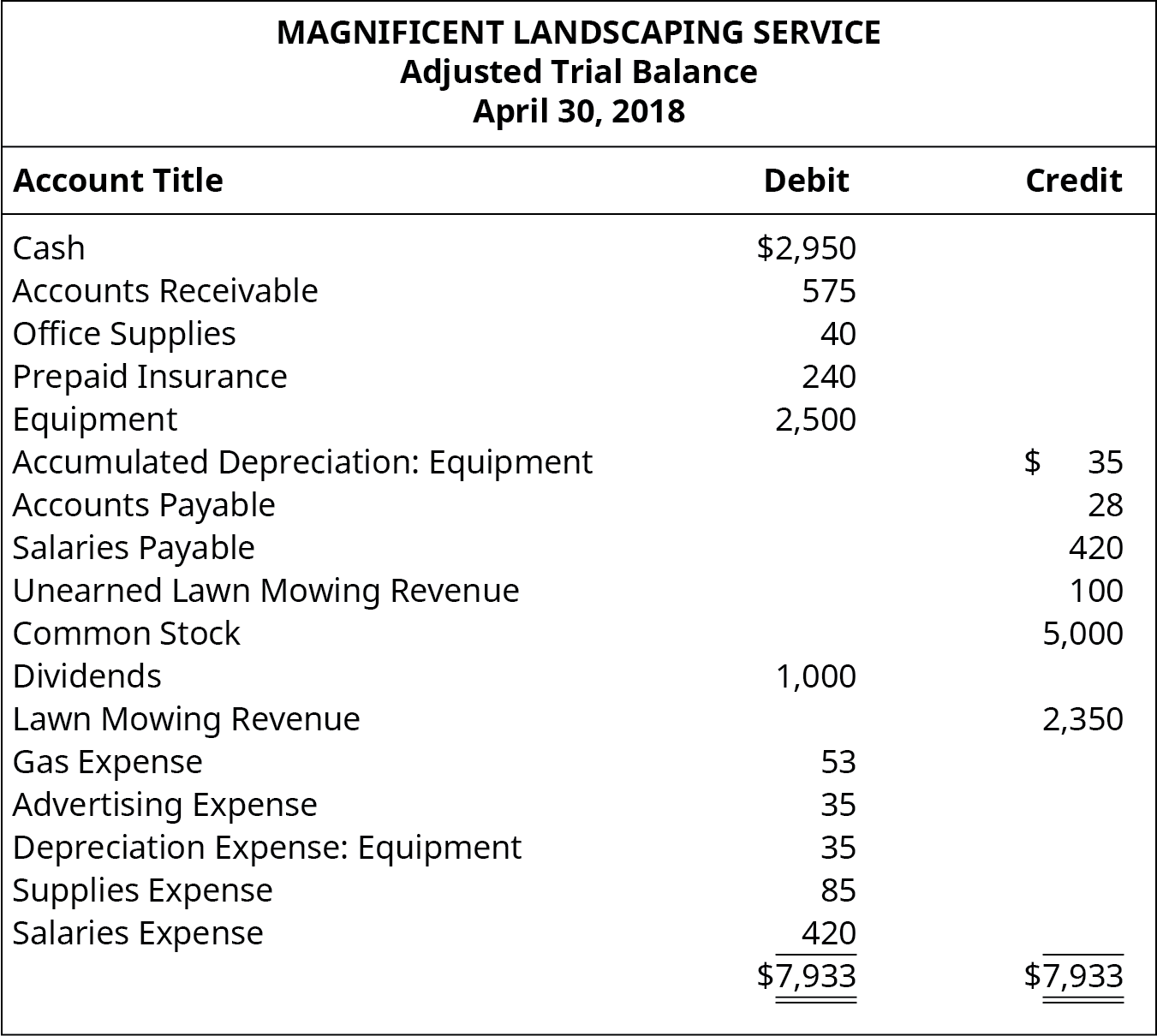

What is Unearned Revenue? QuickBooks Canada Blog

Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web service.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Web accountants list service revenue at the top of the income statement. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Web service revenue is the income a company generates from providing a service. Service revenue appears on a balance sheet as an accounts receivable for.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Service revenue always goes on the. Web accounting for service revenue summary. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Accounts receivable and cash are reported. Web is service revenue on a balance sheet?

Service Revenue On Balance Sheet 5avedesigns

Web accountants list service revenue at the top of the income statement. A balance sheet describes a company's assets, liabilities, and stockholders' or. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. It goes on a separate line item that is specific to revenue, below the.

Solved Presented below are the 2018 statement and

Web accounting for service revenue summary. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web accountants list service revenue at the top of the income statement. The amount is displayed at the top of an income statement and is added to the revenue from.

Unearned Revenue What It Is, How It Is Recorded and Reported

Web accounting for service revenue summary. Accounts receivable and cash are reported. Web accountants list service revenue at the top of the income statement. It goes on a separate line item that is specific to revenue, below the sales revenue line. Web is service revenue on a balance sheet?

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Accounts receivable and cash are reported. Web accounting for service revenue summary. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Service revenue always goes on the. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset).

Does Service Revenue Go On The Balance Sheet cloudshareinfo

The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a. Web service revenue is the income a company generates from providing a service. To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset). Web accounting for service revenue.

Accounts Receivable And Cash Are Reported.

Web for accounting purposes, revenue is recorded on the income statement rather than on a balance sheet. Web accounting for service revenue summary. Web is service revenue on a balance sheet? To summarize, service revenue is reported on an income statement and is not an asset (nor a current asset).

The Amount Is Displayed At The Top Of An Income Statement And Is Added To The Revenue From Product Earnings To Show A.

It goes on a separate line item that is specific to revenue, below the sales revenue line. A balance sheet describes a company's assets, liabilities, and stockholders' or. Service revenue appears on a balance sheet as an accounts receivable for services rendered, which are also known as accounts payable. this amount is. Web service revenue is the income a company generates from providing a service.

Web Accountants List Service Revenue At The Top Of The Income Statement.

Service revenue always goes on the.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)