Depreciation On Balance Sheet Example - For income statements, depreciation is listed as an expense. The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged to expense for the. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. On an income statement or balance sheet. Web depreciation is typically tracked one of two places: Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet.

Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. It accounts for depreciation charged to expense for the. The cost for each year you own the asset becomes a business expense for that. On an income statement or balance sheet. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. For income statements, depreciation is listed as an expense. Web depreciation is typically tracked one of two places:

Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. It accounts for depreciation charged to expense for the. For income statements, depreciation is listed as an expense. The cost for each year you own the asset becomes a business expense for that. Web depreciation is typically tracked one of two places: On an income statement or balance sheet.

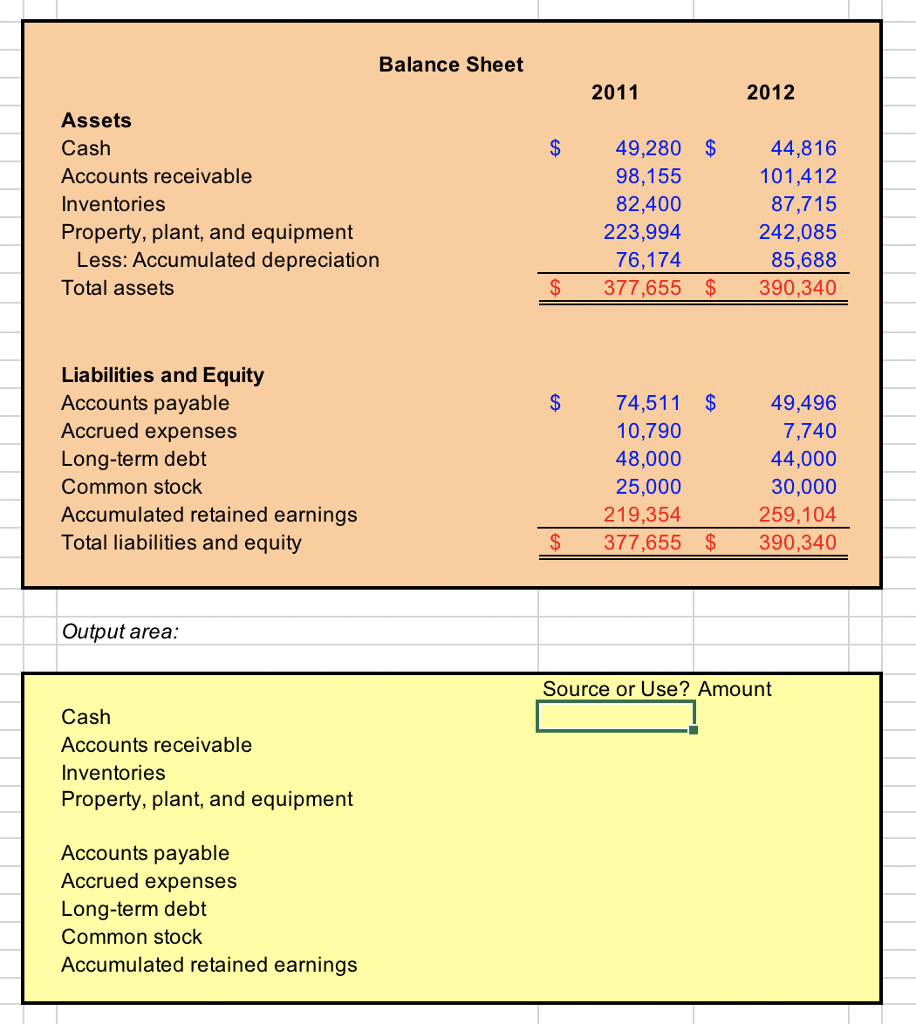

balance sheet Expense Depreciation

Web depreciation is typically tracked one of two places: On an income statement or balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. The cost for each year you own the.

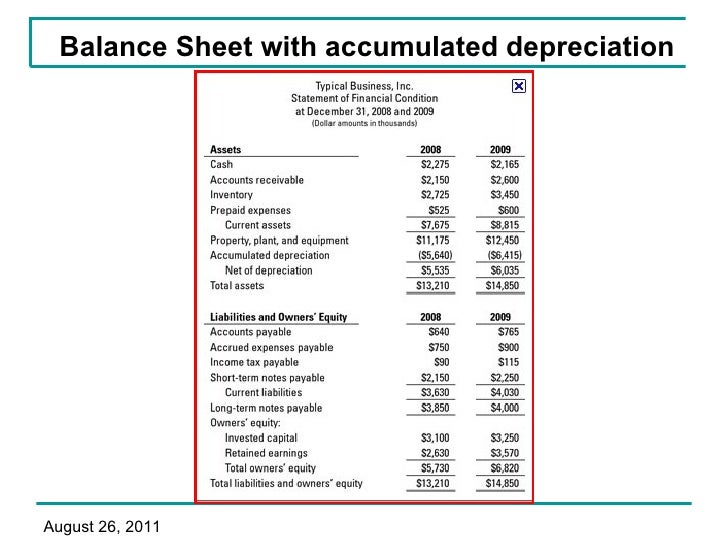

Accumulated Depreciation Formula + Calculator

Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. Web depreciation is typically tracked one of two places: For income statements, depreciation is listed as an expense. On an income statement or balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over.

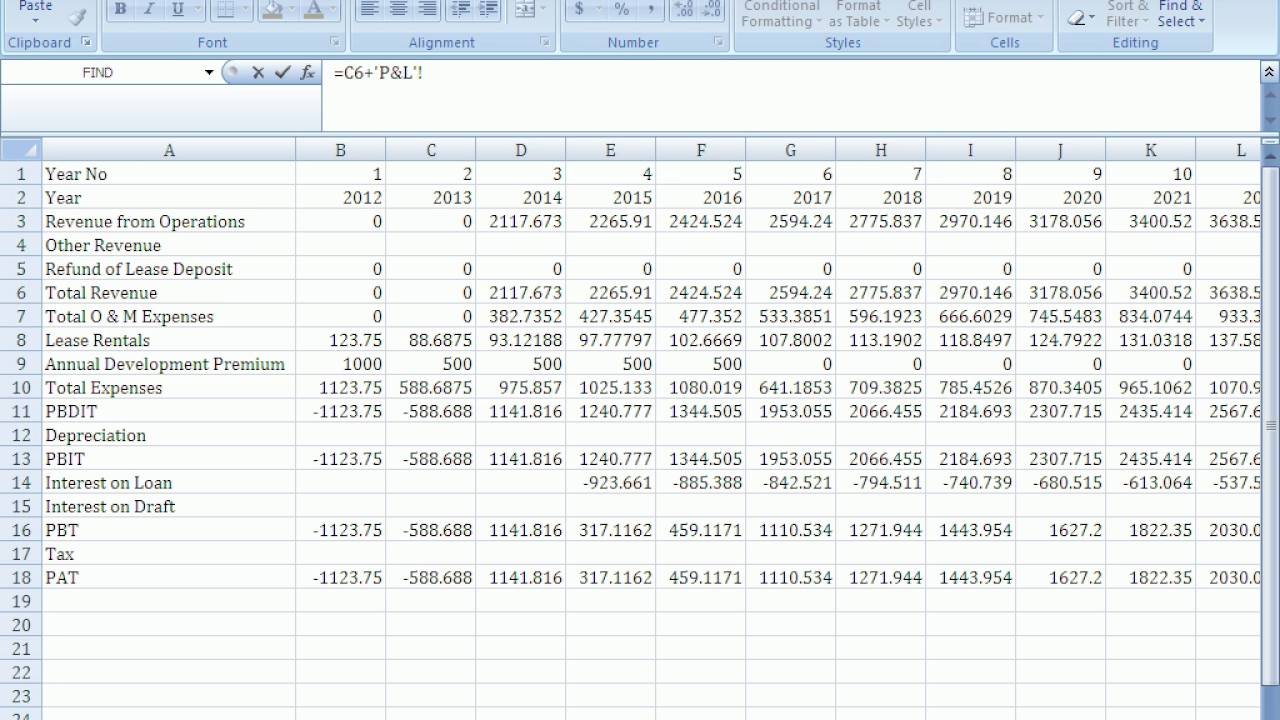

Working with Balance Sheet and Depreciation YouTube

On an income statement or balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web the.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

On an income statement or balance sheet. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. For income statements, depreciation is listed as an expense. It accounts for depreciation charged to expense for the. Web accumulated depreciation is the total.

Balance Sheet Depreciation Understanding Depreciation

For income statements, depreciation is listed as an expense. Web depreciation is typically tracked one of two places: Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged.

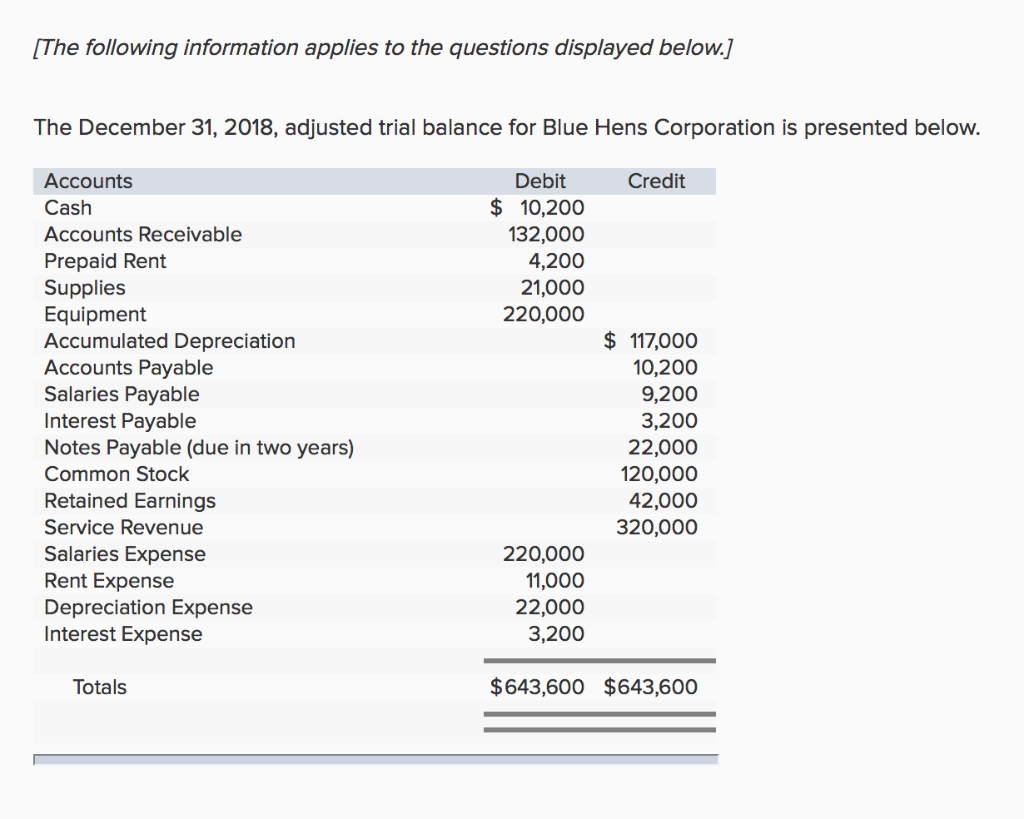

Depreciation

On an income statement or balance sheet. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web depreciation is typically tracked one of two places: Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset.

How To Calculate Depreciation Balance Sheet Haiper

Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. The cost for each year you own the asset becomes a business expense for that. For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on.

template for depreciation worksheet

It accounts for depreciation charged to expense for the. On an income statement or balance sheet. For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web depreciation is typically tracked one of two places:

8 ways to calculate depreciation in Excel Journal of Accountancy

Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged to expense for the. For income statements, depreciation is listed as an expense. Web depreciation is typically tracked.

What is Accumulated Depreciation? Formula + Calculator

Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. It accounts for depreciation charged to expense for the. For income statements, depreciation is listed as.

The Cost For Each Year You Own The Asset Becomes A Business Expense For That.

Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web depreciation is typically tracked one of two places: Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet.

On An Income Statement Or Balance Sheet.

Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. For income statements, depreciation is listed as an expense. It accounts for depreciation charged to expense for the.