Cd Ladder Excel Spreadsheet Template - Benefits of cd laddering how to build a cd ladder best cd ladder strategy for you alternatives to a cd ladder summary what is a cd ladder? Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to understand your options. Web one way to do this is to use a cd ladder calculator excel. I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. The fv function gives the future value of an input number, it requires arguments consisting rate, nper (number of period for compounding), pmt (withdrawable amount), pv (investment). However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. For example, with a $10,000, 1 year cd paying 8 precent interest compounded daily, the principal is $10,000. Before we get into the details of how cd ladders work, let’s start with an example. Web cd ladder calculator citi has cd options to suit your needs. When you open a cd, you select a term, such as six months, two years.

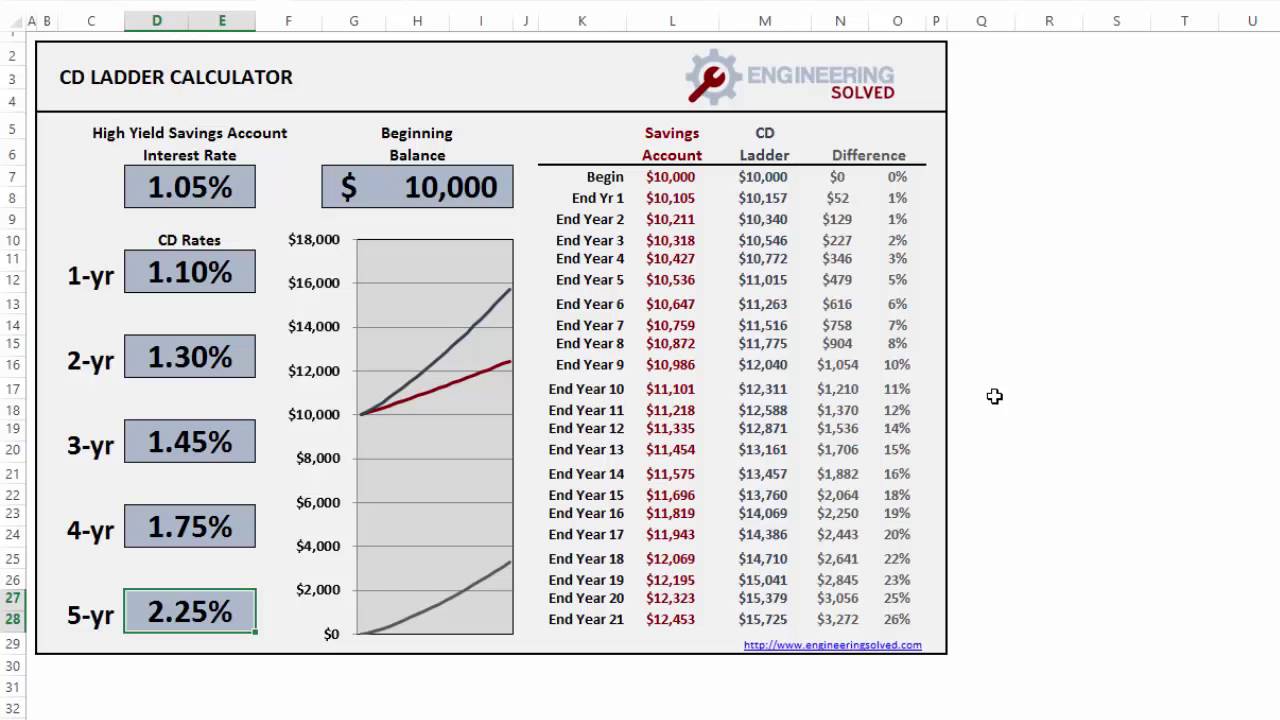

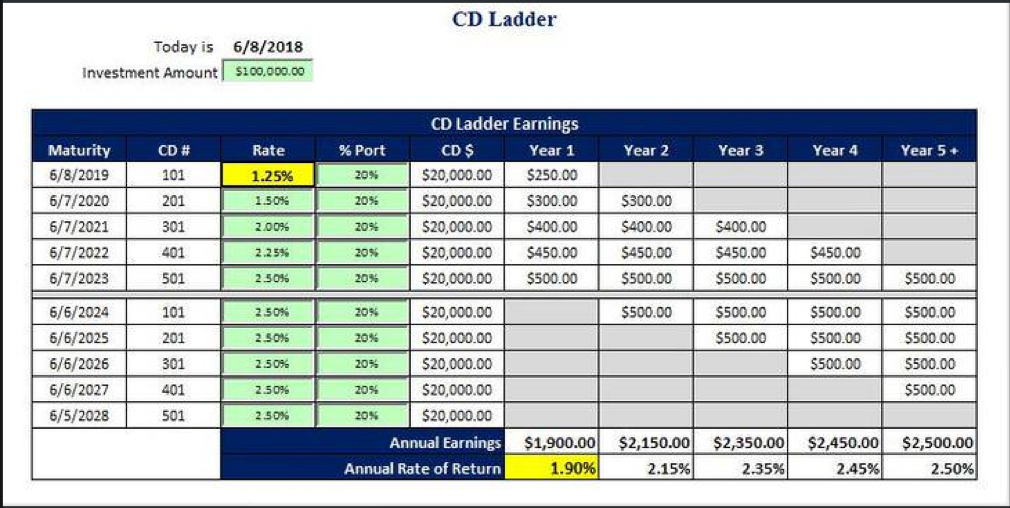

Web the number of cds that will be in your cd ladder. You will have earned $1,304.92 more using cd laddering.* *note that at the end of the time period shown, only a portion of your cd ladder balance is liquid, while the entire single cd balance is liquid. Choose from the tools below to see how this simple method could work for you. Video of the day step 2 type the principal of the cd in cell a2. This calculator allows you to work out the best way to invest your money so that you can get the most interest. This calculator assumes that you redeposit all matured cds into new cds that have a term of the longest maturity in your original cd ladder. Banks typically require a minimum deposit of $500 or higher to open a cd account. With a bond/cd ladder, by the way, i mean holding a portfolio of bonds and/or cds so the cash flows comprised of maturing cds/bonds plus interest income exactly matches a specified time series of target cash flows over time. Compare cd rates and start building your cd ladder today. Learn more about citi cds and cd rates.

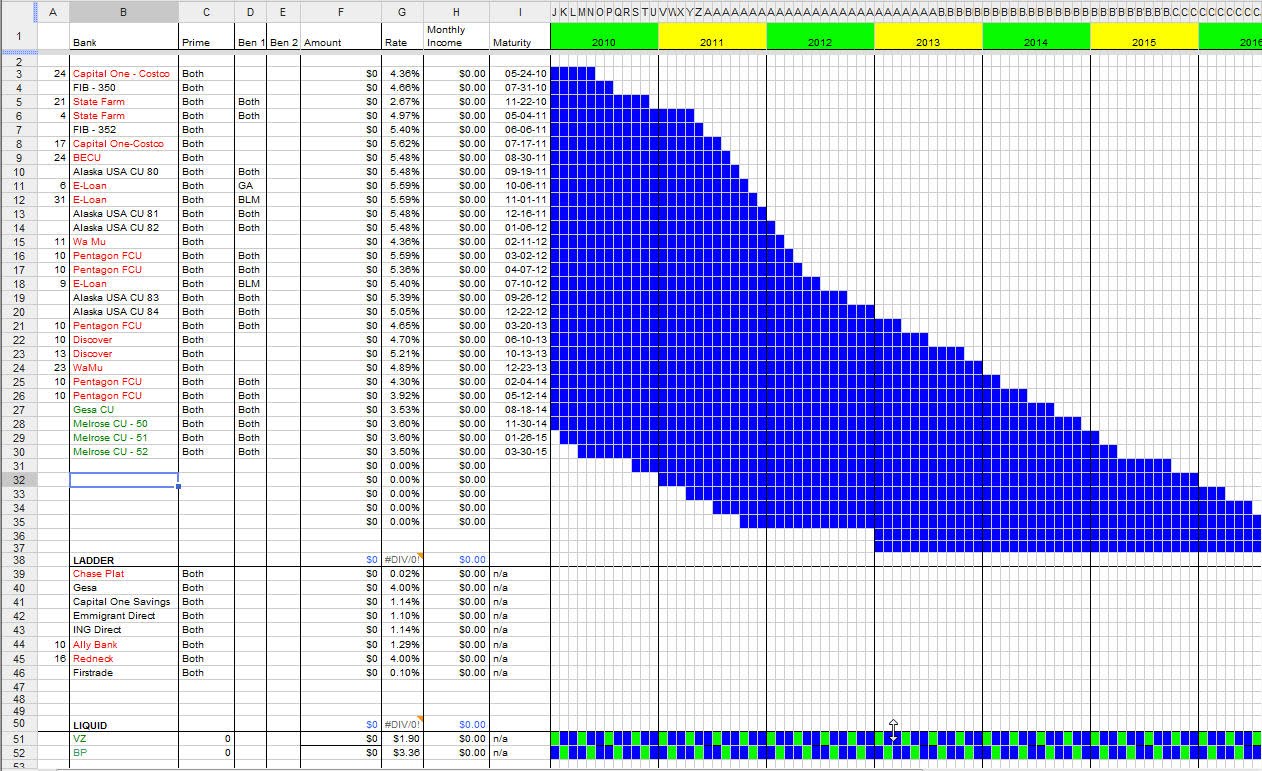

Web a while ago i created a little toolkit to design my own bond and/or cd ladder. The benefits of cd laddering. Web cd ladder calculator citi has cd options to suit your needs. Web table of contents what is a cd ladder? When you open a cd, you select a term, such as six months, two years. However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Of course, if you’re regular readers of. Some minimum requirements can reach as high as $10,000 while other banks don’t require a minimum at. Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! Web cd ladder overview the basics step by step quick calculator quick cd ladder calculator choose your terms and total deposit to estimate your earnings.

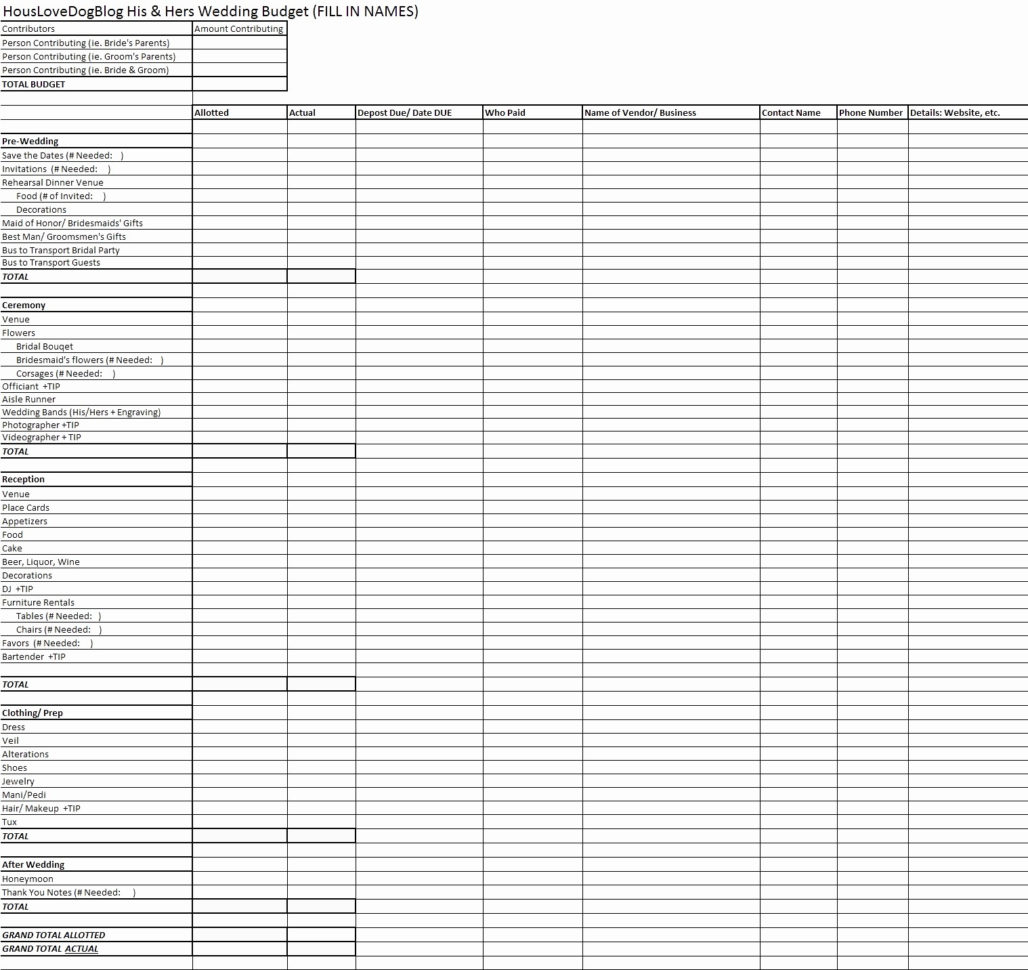

Cd Ladder Spreadsheet Template pertaining to Cd Ladder Spreadsheet

Some minimum requirements can reach as high as $10,000 while other banks don’t require a minimum at. When you open a cd, you select a term, such as six months, two years. Benefits of cd laddering how to build a cd ladder best cd ladder strategy for you alternatives to a cd ladder summary what is a cd ladder? Now.

Cd Ladder Calculator Excel Spreadsheet Spreadsheet Download cd ladder

Benefits of cd laddering how to build a cd ladder best cd ladder strategy for you alternatives to a cd ladder summary what is a cd ladder? Individualize along with manage your very own information. Web cd ladder calculation example. Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to.

My Financial Demise? Tracking CD Ladders

Use excel fv function to create cd interest calculator in this method we will use the fv function of excel to make a cd interest calculator. Choose from the tools below to see how this simple method could work for you. Web one way to do this is to use a cd ladder calculator excel. I’m trying to create an.

Cd Ladder Excel Spreadsheet —

Calculator assumes that as each cd in the ladder matures, it is renewed for the term, interest rate, and annual percentage yield (apy) associated with the longest term cd in the laddered portfolio. For example, with a $10,000, 1 year cd paying 8 precent interest compounded daily, the principal is $10,000. A certificate of deposit, or cd, is like a.

7. CD Ladder Simplified YouTube

Cds explained similar to savings accounts, cds are tools offered by financial institutions to help you save money while earning interest. There are a few things you need to know before you can start using the calculator. When you open a cd, you select a term, such as six months, two years. Before we get into the details of how.

Here’s Why You Should Consider a CD Ladder as a Savings Tool American

Benefits of cd laddering how to build a cd ladder best cd ladder strategy for you alternatives to a cd ladder summary what is a cd ladder? Search spreadsheets by type or topic, or take a look around by browsing the catalog. This calculator assumes that you redeposit all matured cds into new cds that have a term of the.

Cd Ladder Calculator Excel Spreadsheet Spreadsheet Download cd ladder

If you're looking for a savings strategy with both short and long term benefits, consider cd laddering. Web cd ladder overview the basics step by step quick calculator quick cd ladder calculator choose your terms and total deposit to estimate your earnings. Compare cd rates and start building your cd ladder today. Banks typically require a minimum deposit of $500.

Cd Ladder Excel Spreadsheet With Cd Ladder Spreadsheet Csserwis — db

Web cd ladder calculation example. If you're looking for a savings strategy with both short and long term benefits, consider cd laddering. There are a few things you need to know before you can start using the calculator. Compare cd rates and start building your cd ladder today. Calculator assumes that as each cd in the ladder matures, it is.

Cd Ladder Calculator Excel Spreadsheet —

Web table of contents what is a cd ladder? Web step 1 label cell a1: I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. Of course, if you’re regular readers of. Learn more about citi cds and cd rates.

Cd Ladder Excel Spreadsheet Pertaining To An Awesome And Free

Of course, if you’re regular readers of. Web should i build a cd ladder? With a bond/cd ladder, by the way, i mean holding a portfolio of bonds and/or cds so the cash flows comprised of maturing cds/bonds plus interest income exactly matches a specified time series of target cash flows over time. Web table of contents what is a.

You Can Use Cds Or Ira Cds.

Web a while ago i created a little toolkit to design my own bond and/or cd ladder. Search spreadsheets by type or topic, or take a look around by browsing the catalog. Web step 1 label cell a1: Web cd ladder overview the basics step by step quick calculator quick cd ladder calculator choose your terms and total deposit to estimate your earnings.

Cds Explained Similar To Savings Accounts, Cds Are Tools Offered By Financial Institutions To Help You Save Money While Earning Interest.

A certificate of deposit, or cd, is like a special type of savings account. Banks typically require a minimum deposit of $500 or higher to open a cd account. When you open a cd, you select a term, such as six months, two years. Web for anyone interested in laddering their investments in bank certificates of deposit (cds), this spreadsheet may be of great benefit.

Do Not Throw Away Your Energy!

If you're looking for a savings strategy with both short and long term benefits, consider cd laddering. Each cd will have a different maturity date, so that one of your cds will mature at the frequency you specify. Choose from the tools below to see how this simple method could work for you. Web the number of cds that will be in your cd ladder.

Some Minimum Requirements Can Reach As High As $10,000 While Other Banks Don’t Require A Minimum At.

Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Select the template that fits you best, whether it's a planner, tracker, calendar, budget, invoice, or something else. Web $10k $100k $1m frequency of maturing cd:* ? Web what can a cd ladder do for you?